Artificial intelligence in the financial sector – the next big thing?

by Jochen Werne

Google, Apple, Facebook and Amazon (GAFA) have long seen artificial intelligence as the technology of the future. AI also holds enormous potential for banks and FinTechs. After “FinTech”, “Blockchain” and “Crypto currency”, “AI” is therefore the new buzzword in the banking world. From the AI-optimized chatbot to the highly complex, self-learning investment algorithm – the omnipresence of the term suggests that the integration of Artificial Intelligence into one’s own business model seems to be virtually vital. To what extent is this true?

What becomes possible in times of exponential technologies is nothing less than a revolution. The financial sector holds a vast amount of valuable and already processed data. They not only reflect our daily and extremely private lives – from buying a hot cappuccino in the coffee shop in the morning, for example, to the preference of our Christmas presents – but also the payment flows of entire companies and industries and therefore our entire economy. Maturing AI systems make the preparation and processing of data not only easier, but also much more cost-effective, faster and more targeted. Every electronic transaction generates customer-specific data. These structured data records, which have already been collected for many years, become the most valuable raw material and a resource which, in combination with the enrichment of external, possibly non-structured data, must be made “usable” in a meaningful way. AI will not only enable banks to make their services even more customized, it will also make its way into most areas of the financial industry – from asset management to business operations, money laundering prevention and marketing.

Trust is and remains one of a bank’s most important assets. And today, more than ever, the protection of customer data in a digital banking world has absolute priority. When using AI technology, it is crucial to use private and sensitive data in the interests of the customer. And this is where not only the IT and Cyber Security departments of the banks come into play, but also politics: It is primarily their task to find regulations for the handling of effects oon society, the economy and thus on our lives and the work of tomorrow. The fact that this topic is taken very seriously is evident not only in national initiatives such as the German Platform for Artificial Intelligence “Learning Systems”, but also in the joint European Artificial Intelligence approach, which is being driven forward at full speed by France and Germany.

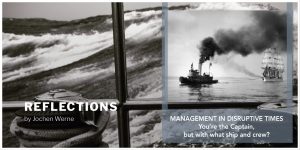

The use of AI technologies in consulting practice in the financial services industry shows that a purely virtual “consultant” is not sufficient for all target groups to offer comprehensive, sustainable support. The background to this can be found in the teachings of Nobel Prize winners Daniel Kahneman and Amos Tversky and their Behavioral Finance research studies, a subfield of behavioral economics. The lessons prove that emotional – i.e. human – behaviour can lead to repeated mistakes when it comes to investing money. Financial markets are volatile by nature and every perceived movement – especially downwards – triggers an emotional reaction in the investor, such as uncertainty or fear of loss. This leads to a “biased reaction”, such as buying or selling a security at the wrong time – a reaction without appropriate and rational consideration of the overall situation. In such moments of strong imbalance between ratio and emotion, AI reaches its limits. In his Behavioral Finance studies, Kahneman impressively illustrates how memories of negative events are anchored more than twice as strongly in memory as positive experiences. An interim loss in value of 30 percent is a good opportunity for a long-term investor to buy back. But in order to convert this a crisis moment into an opportunity, the question arises whether rational investor considerations can be caused in times of panic better by a chatbot or a human.

- see all business publications here