By Jochen Werne

Introduction

“The future belongs to those who can turn data into responsibility.”

This thought has accompanied me throughout my professional journey at the intersection of technology, regulation, and innovation. Today, the transformative role of machine learning (ML) in risk management is no longer a prediction; it is a tangible reality reshaping financial services and other industries.

The recent Forrester Study commissioned by Experian provides compelling evidence that ML does not merely hold theoretical promise. It delivers measurable benefits – from accelerating decision-making to reducing defaults, from broadening financial inclusion to strengthening institutional profitability.

The respected publication IT FinanzMagazin captured these findings in an article that highlights the impact of ML in the German financial sector:

From Data to Better Decisions: ML Changes Risk Models in Finance

In this essay, I would like to extend that conversation: to reflect on the findings, to place the quotes of Mariana Pinheiro (CEO Experian EMEA & APAC) and myself into context, and to explore why ML must be viewed not only as a technological breakthrough, but as a matter of trust, responsibility, and vision.

The complete study can be accessed here: 👉 Experian Forrester Research Report 2025

Germany’s Leadership in ML Adoption

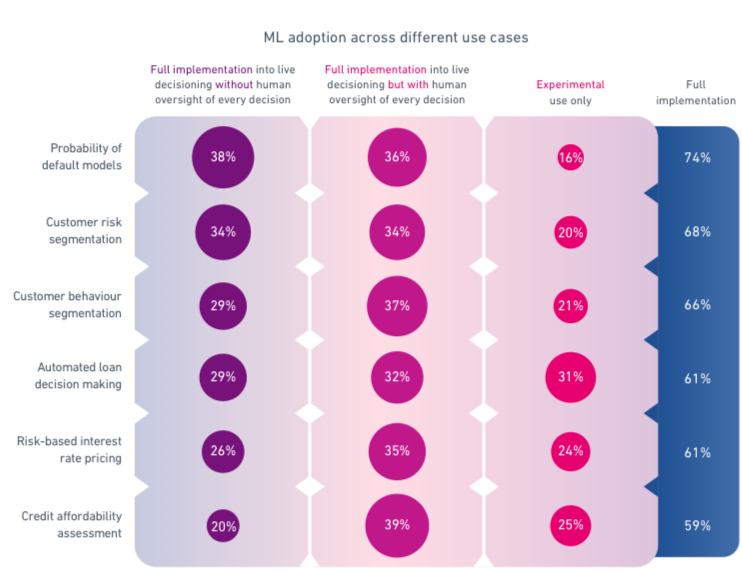

The study underscores that German financial institutions are ahead of the curve in implementing ML for credit decisioning and risk management.

- 80% of German lenders now automate credit decisions – significantly above the international average.

- 95% report improved approval rates for SME loans.

- 95% record reduced default rates in credit card portfolios.

- 84% already employ Generative AI to accelerate model development and streamline compliance.

These are not incremental improvements. They reflect a paradigm shift: one in which precision, speed, and inclusivity converge to create both economic and societal value.

Two Complementary Perspectives

The IT FinanzMagazin article highlighted two quotations which, in my view, perfectly capture the essence of the Forrester Study:

“By using alternative data and more advanced risk models, ML enables lenders to make fairer and more accurate decisions, particularly for consumers with limited financial histories. This technology is becoming a central component in building more inclusive and sustainable financial systems.”

Mariana Pinheiro, CEO Experian EMEA & APAC

“With ML, extensive datasets can be optimally utilised, thereby achieving the highest levels of accuracy in credit decisioning. In this way, companies can maximise profitability while simultaneously minimising financial risk. On this basis, credit institutions can achieve sustainable growth and open up new customer segments.”

Jochen Werne, CEO Experian DACH

Taken together, these perspectives articulate a crucial truth: machine learning is not merely a technological upgrade; it is a strategic enabler of both profitability and financial inclusion.

The Opportunities Before Us

The Forrester Study identifies three domains where ML presents immediate, compelling opportunities:

1. Precision and Acceleration

ML enables credit decisions to be rendered in seconds without compromising accuracy. This improves customer experience, enhances operational efficiency, and reduces costs.

2. Financial Inclusion

By incorporating alternative data sources, ML makes it possible to serve underrepresented segments – such as individuals with limited credit histories – fairly and effectively. The result is broader access to finance and new growth opportunities for lenders.

3. Compliance and Transparency through GenAI

Generative AI is increasingly being deployed to simplify documentation, validation, and regulatory reporting – addressing one of the most persistent concerns about ML: its explainability.

The Challenges We Must Address

No transformation is without barriers.

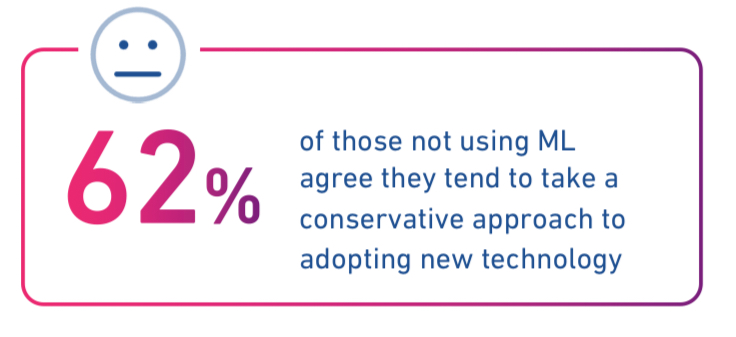

- Cost: Many institutions perceive implementation expenses as prohibitive.

- Explainability: 62% express concern over the transparency of ML models.

- Skills and governance: A shortage of data science capabilities and the need for robust governance frameworks remain pressing issues.

These challenges are real, but they are not insurmountable. They are, rather, an invitation to leadership – to treat complexity not as an obstacle, but as a design principle for sustainable success.

A Call to the Industry

The findings of this study are not merely academic. They represent a wake-up call for financial institutions, regulators, and technology providers alike.

We are at a moment when technology and regulation, profitability and responsibility, innovation and trust must be harmonised.

Handled wisely, ML can become a catalyst for stability, growth, and inclusion. Handled poorly, it risks exacerbating inequality and undermining confidence. The choice is ours.

As CEO of Experian DACH, I see it as our mission to bridge this divide: to provide not only technology and data, but also the governance frameworks and partnership ethos that enable ML to be adopted responsibly and effectively.

Looking Ahead

The Forrester Study also points to the future trajectory of ML in risk management:

- Adaptive risk models that continuously learn and adjust in real time.

- Cross-domain and multimodal models integrating data from telecommunications, e-commerce, and IoT.

- AI-driven regulatory technology (RegTech) that ensures compliance while reducing administrative burden.

- Fairness and ethics frameworks designed to identify and mitigate bias.

- Ecosystem platforms where banks, fintechs, and data providers collaborate to accelerate adoption at scale.

In Europe, the evolving AI Act and regulatory guidance from the EBA and ECB will further shape these dynamics. Institutions that act early to embed compliance into innovation will enjoy a decisive advantage.

Conclusion

The IT FinanzMagazin article performs an important service by bringing the insights of the Forrester Study into sharper focus for the German market. The study itself offers more than statistics: it provides strategic orientation at a time when financial institutions must decide whether they will lead or lag in the adoption of ML.

For me personally, these findings reaffirm a conviction: that technology, business value, and regulatory integrity must be pursued together – never in isolation.

Germany is well positioned to set international standards in ML-driven risk management. But leadership requires courage: the courage to invest, the courage to embrace transparency, and above all, the courage to place trust as the ultimate currency at the heart of financial services.

The full study is available here:

👉 Experian Forrester Research Report 2025

🔗 References:

- IT FinanzMagazin: From Data to Better Decisions

- Experian: Forrester Research Report 2025