Reflections on my conversation with Nils Kreimeier, host of the Capital – The Business Podcast

On 5 February 2026, I had the pleasure of joining Capital – The Business Podcast to speak about one of the most pressing challenges of our time: the dramatic escalation of fraud in the digital era and the role that artificial intelligence is playing in reshaping risk landscapes globally. I would like to begin by expressing my sincere thanks to the host and editorial team at Capital for the invitation and for a thought-provoking dialogue. Our conversation has resonated with many leaders across industries because it touches on issues affecting not only financial institutions but every organisation and individual engaged in the digital economy.

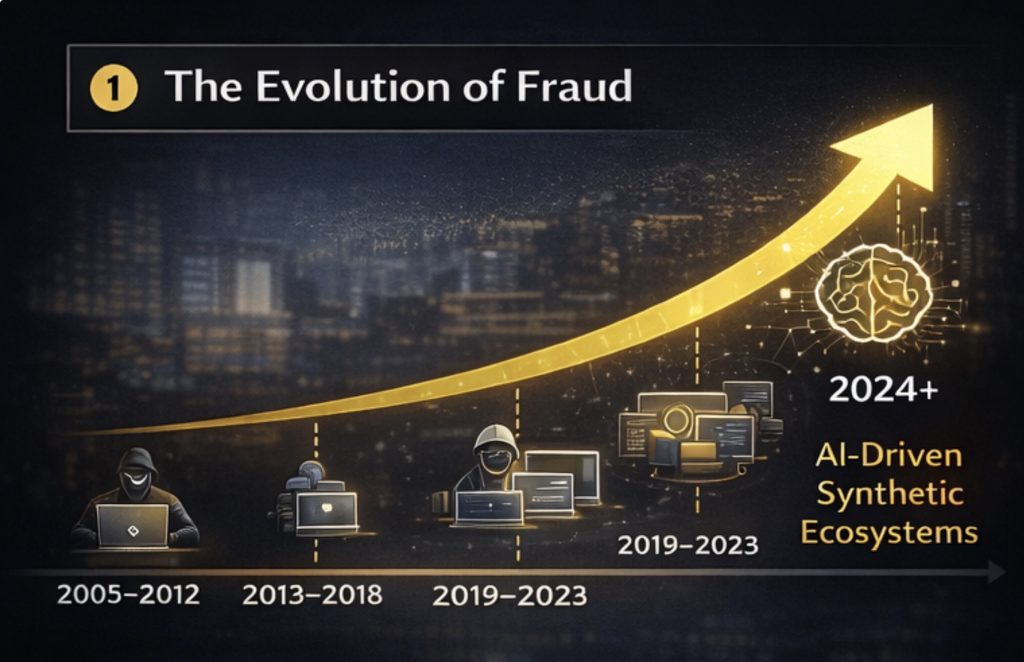

The central observation of the podcast was straightforward but deeply consequential: fraud cases have risen massively, and the intelligence behind them has increased. In my role as a business leader, I see this movement every day — it is not just the number of incidents that is increasing, but the sophistication of those perpetrating fraud.

In the episode, which runs approximately 28 minutes, we explored why fraud is accelerating, how technologies are amplifying both risk and response, and what organisations must do to adapt. My remarks drew on data and trend lines that we observe in the market, including the fact that we are now seeing fraud losses in the hundreds of billions of dollars worldwide — a truly systemic issue that demands systemic solutions.

Understanding the Surge in Fraud

When we look at the evolution of fraud over the past decade, we see a clear pattern: risk tends to migrate to where opportunity and anonymity intersect. In a hyper-connected, digital-first world, the scope of financial decisioning, e-commerce, lending, and digital identity verification has exploded. But while digital channels expand access and convenience, they also expose new attack vectors. AI and machine learning systems have dramatically increased the reach and automation of fraud schemes.

What makes the current situation distinct is not just volume, but intelligence. Modern fraud actors use sophisticated tools and tactics to mimic legitimate behaviour, automate attacks, and evade traditional defenses. At the same time, legitimate businesses increasingly rely on automated flows and real-time decisions, granting little margin for error. This creates a tension between speed and security that only advanced analytical technologies can help resolve.

The Role of Artificial Intelligence

During the podcast, I emphasised that AI is not merely an accelerant of fraud — it is the architecture of the modern fraud landscape. Generative models and agentic AI frameworks can create synthetic identities, automate account takeover sequences, and generate highly believable phishing content. These capabilities were once confined to deep technical labs; today they are accessible broadly, lowering barriers for fraud operations around the world.

Yet, it is essential to recognise that AI also offers the most promising counterweight. At Experian, we have transitioned from rule-based systems to proactive, AI-driven defense platforms. These systems leverage pattern recognition, behavioural analytics, and real-time feedback loops to detect anomalies that would elude static filters. The future of fraud prevention must rest on adaptive, intelligent systems that learn and evolve at the speed of the threat.

Why Traditional Approaches Fall Short

For many years, credit and risk professionals have relied on static rules — lists of forbidden behaviours, thresholds of suspicious activity, or manual reviews triggered by fixed criteria. These approaches were never fully adequate, but in an environment where fraud patterns evolve daily, they are simply obsolete. Fraudsters test rules, learn them, and find loopholes. What worked in 2015 may be irrelevant in 2026.

In contrast, machine learning models that analyse multi-dimensional signals — such as device fingerprinting, behavioural biometrics, transaction context, and network effects — can detect patterns that have no single definable rule. This shift from reactive defense to predictive shielding is the foundation of modern risk management.

Implications for Businesses and Customers

The implications of this landscape are profound:

- For financial institutions, the need to invest in AI-enabled risk systems is no longer optional — it is integral to competitiveness and stability.

- For merchants and platforms, fraud is a cost centre that directly affects margins, customer trust, and brand reputation.

- For consumers, increased fraud means greater friction in identity verification and account setup, but it also elevates expectations for secure digital experiences.

- For regulators and policymakers, the challenge is to design frameworks that encourage innovation while protecting citizens and markets.

One cannot overstate the importance of collaboration across sectors: public sector, private sector, and civil society must share insights, threat intelligence, and best practices. No single organisation can mitigate systemic risk alone.

Cybersecurity and Digital Trust

Our conversation in the podcast also touched on a broader theme: digital trust. Trust is the currency of the digital economy. When trust erodes—whether through data breaches, fraud losses, or identity theft—users become reluctant to participate in online platforms and digital services. This has cascading effects, reducing economic activity and slowing innovation.

Trust is built through transparency, accountability, and resilience. Organisations must invest not only in technology but in governance structures that prioritise ethical data usage, privacy compliance, and user empowerment. Only then can we create digital ecosystems where individuals feel confident that their personal and financial information is secure.

A Call to Action

Towards the end of our episode, I discussed the urgent need for organisations to rethink their risk strategies. This means:

- Investing in next-generation analytics and AI models that can adapt to emerging threats.

- Embracing cross-industry cooperation on fraud intelligence sharing.

- Prioritising user-centric security design so that legitimate customers are not burdened by unnecessary friction.

- Supporting policy frameworks that balance innovation with risk mitigation.

The landscape of fraud will never be static. As technologies evolve, risk actors will experiment and adapt. But the direction is clear: organisations that integrate advanced AI into their fraud defenses, and that build trust as a strategic priority, will be the ones that thrive.

Thanks and Looking Ahead

I remain grateful to Capital – The Business Podcast for the opportunity to highlight these issues. Conversations like the one we had help broaden understanding and encourage leaders across sectors to act decisively. As we move forward in 2026 and beyond, I am optimistic about the partnerships and innovations that will shape a safer digital future.

For those interested in exploring this topic further — whether from a strategic, technological, or policy angle — I encourage you to listen to the full podcast episode and engage with the ideas we discussed. The challenge of fraud is complex, but with the right mindset and tools, it is one we can meet together.AI-Driven Fraud and the Future of Digital Trust