GOVERNANCE TODAY: One of the best descriptions about the role of the Chief Visionary Officer can be found on Wikipedia

A chief visionary officer or chief vision officer (CVO) is an executive function in a company like CEO or COO. The title is sometimes used to formalize a high-level advisory position and other times used to define a higher ranking position than that held by the CEO. In some cases, the CVO is added to the CEO title (for CEO/CVO status), much in the same way that people with multiple university degrees list them after their names.

The CVO is expected to have a broad and comprehensive knowledge of all matters related to the business of the organization, as well as the vision required to steer its course into the future. The person in charge must have the core-competencies of every executive, and the visionary ideas to move the company forward, defining corporate strategies and working plans. The role has expanded to include formalizing the company’s strategic-planning processes, forging new working relationships and synergies across the organization, and establishing greater transparency and accountability for those people carrying out the company’s strategy.

Companies add CVOs (or consider doing so), sometimes interchangeable with CSO – Chief Strategy Officer, to their management teams for several reasons. Changes to the business landscape — complex organizational structures, rapid globalization, new regulations, the struggle to innovate — make it more difficult for CEOs to be on top of everything, even in areas as important as strategy execution and vision direction. Strategy development has become a continuous process, and successful execution depends on rapid and effective decision making. Further, as Harvard Business School professor Joseph L. Bower has noted, iron-fisted control of execution often eludes the top team’s grasp, as line executives seek to define strategy on their own terms. (See Bower and Clark G. Gilbert’s “How Managers’ Everyday Decisions Create—or Destroy—Your Company’s Strategy,” February 2007.)

Einar Stefferud, co-founder and CVO of First Virtual Holdings in 1994, is usually recognized as the first CVO. Another early CVO was Tim Roberts of Broadband Investment Group. Roberts said[citation needed] he invented the title to recognize the visionary attributes needed to integrate a complex business with many diverse aspects. Roberts chose the title to define his role in the organization, and didn’t intend the designation to proliferate across the corporate world in the way that it has.

It is with pride to serve PROSEGUR Cash Services Germany as Chief Development & Chief Visionary Officer in one of the most fascinating times of techological progress and transformation

Jochen Werne

Jochen Werne is the new Chief Development & Chief Visionary Officer of Prosegur Cash Services Germany GmbH

Monday, 18 November 2019

Member press release

° Digital and transformation expert to support strategic development internationally

° Heath White continues to drive forward strategy on innovations and new products

Prosegur Cash Services Germany

Ratingen (Germany), 18 November 2019 – Jochen Werne has been strengthening the C-Suite of Prosegur Cash Services Germany GmbH since 1 November 2019 as a member of the Management Board and Chief Development & Chief Visionary Officer (CDO/CVO).

“With Jochen Werne, we have been able to win an internationally networked and leadership-strong digital and transformation expert for Prosegur. The focus of his work at Prosegur will be the development and implementation of the strategy for Business Development, Innovation, II&S (Innovative Integrated Solutions), Business Process Outsourcing, New Products and International Sales. We expect that his industry expertise will provide our company with further impulses that will enable us to set trends in a market environment that is changing dynamically due to new technologies,” explains Heath White, CEO Prosegur Cash Services Germany GmbH.

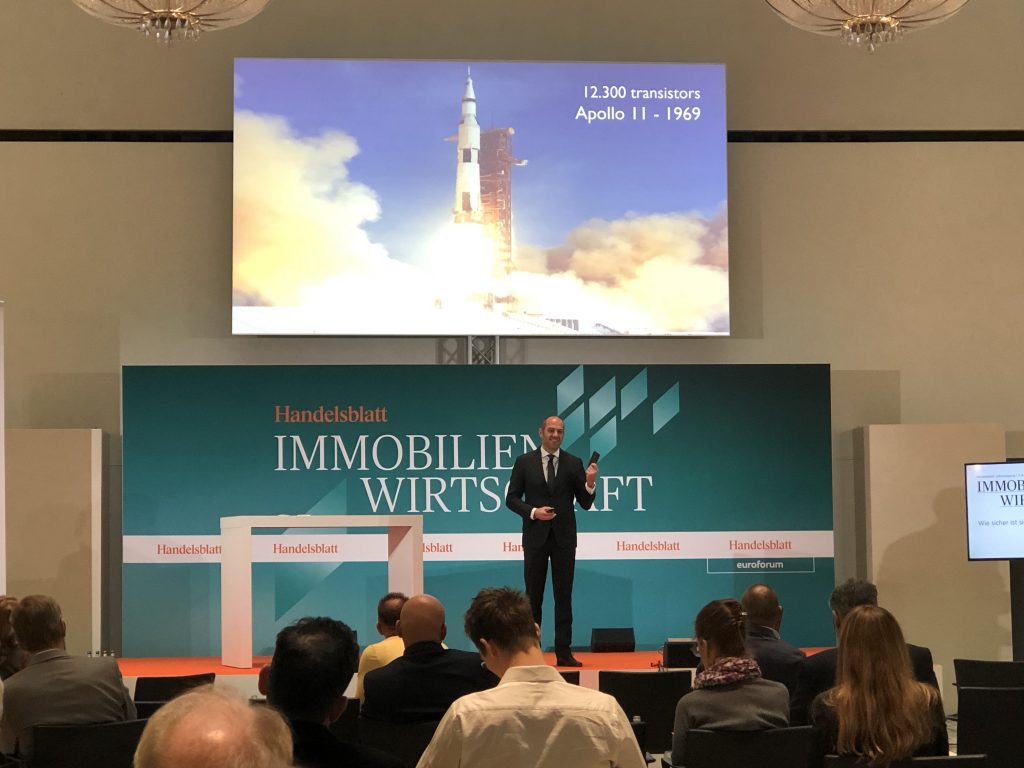

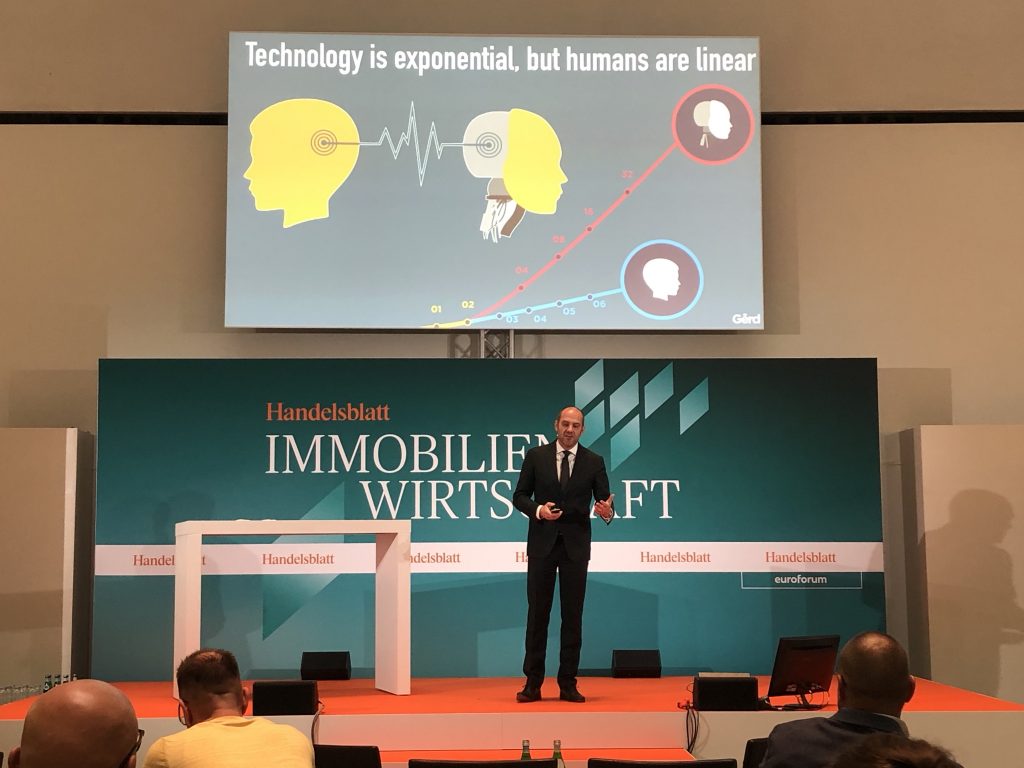

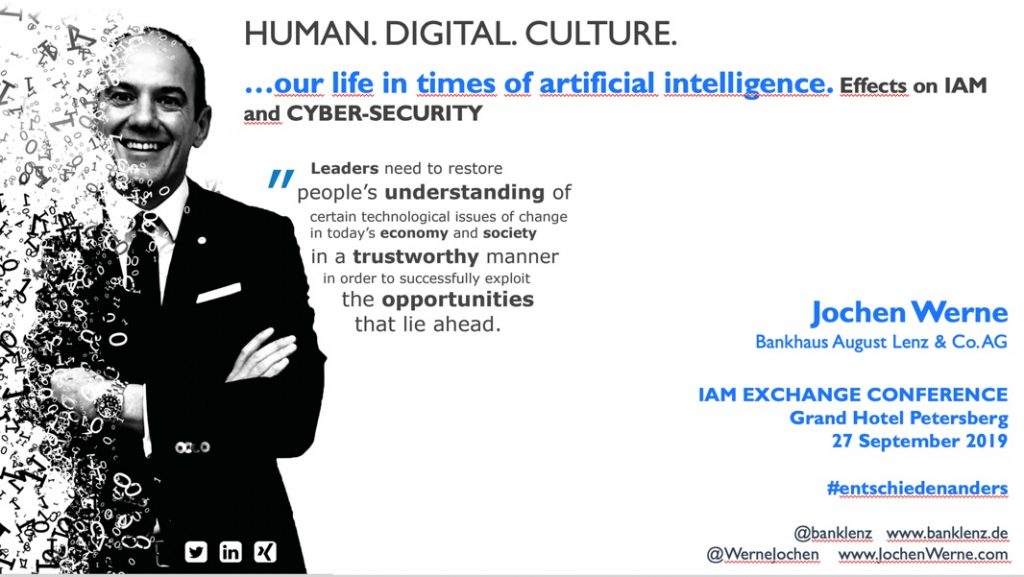

Werne’s academic career has taken him to the University of Passau, the J.W. Goethe University Frankfurt a. M., the Helsinki School of Economics and Oxford University. He started his professional career in Global Investment Banking at Bankers Trust and Deutsche Bank AG. After a leading position in a start-up for electronic trading platforms and as a management consultant at Accenture, he joined Bankhaus August Lenz & Co. AG, where he headed various departments of the bank. According to Fintech Finance, during this time the bank transformed itself from an analogue private bank to a driver of innovation in digitalisation.

Werne is a member of the platform “Learning Systems” for artificial intelligence. This platform was initiated by the Federal Ministry of Education and Research. He is also a member of the Royal Institute of International Affairs, Chatham House. He is a keynote speaker, author and co-author of numerous specialist books and articles. He has received several international awards for his commitment to the development of diplomatic relations between nations.

About Prosegur

Prosegur is one of the leading security service providers worldwide with more than 175,000 employees on five continents. In Germany, Prosegur offers comprehensive services in security logistics with 31 branches and more than 4,000 employees. In the cash and valuables transport sector, Prosegur has the largest share of the industry’s turnover. The service portfolio includes automated cash processes and ATM services in addition to cash and courier logistics and cash management. With the automated deposit solutions “Prosegur Smart Cash”, customers optimize their cash handling. Following the acquisition of BaS Solution, Prosegur is one of the few cash and valuables logistics providers to offer technical services from a single source throughout Germany. The company bundles its social and cultural commitment in the Prosegur Foundation, which benefited over 43,200 people in 2018.

Media contact:

Agency komm.passion GmbH

Gernot Speck

Phone: 0211 / 600 46 271

e-mail: prosegur@komm-passion.de

Press Release translated with www.DeepL.com/Translator