The crypto market has become and will remain an undeniable part of our financial system and Germany has become the frontrunner in regulating the market

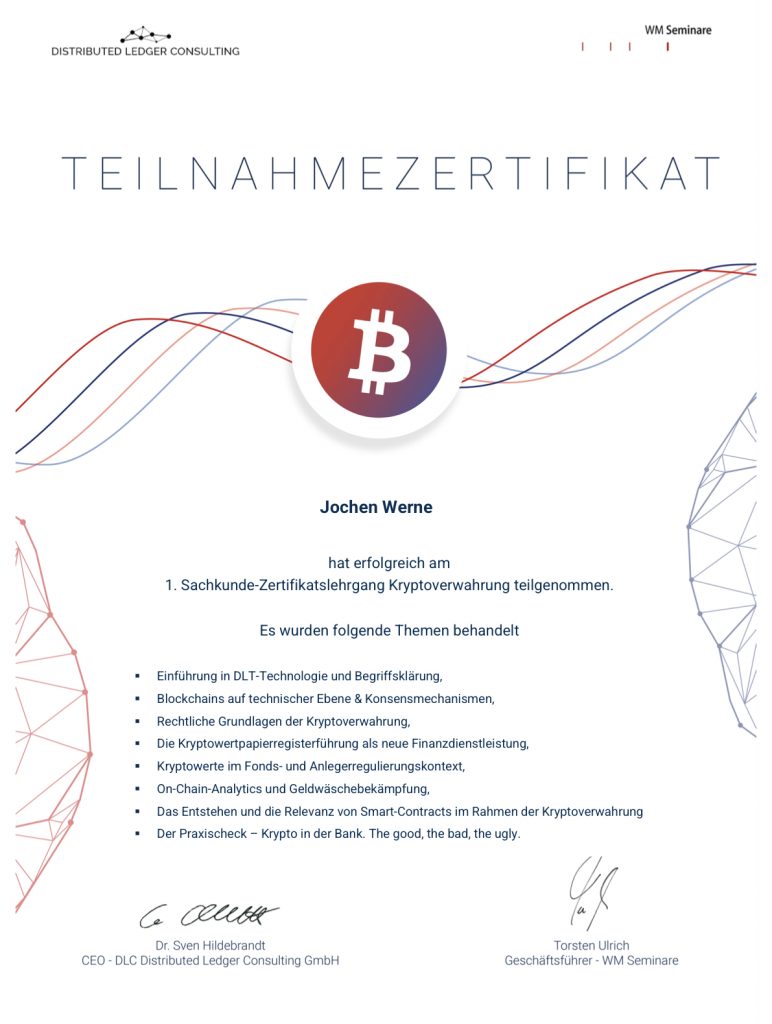

Jochen Werne

The German Act Implementing the Amending Directive on the Fourth EU Anti-Money Laundering Directive (Federal Law Gazette I of 19 December 2019, p. 2602 (Gesetz zur Umsetzung der Änderungsrichtlinie zur Vierten EU-Geldwäscherichtlinie) has included crypto custody business in the German Banking Act (Kreditwesengesetz – KWG) as a new financial service. Since the Act came into force on 1 January 2020, undertakings wishing to provide this service are required to apply for an authorisation from BaFin.

One of the prerequisites receiving the authorisation is the proof the the managing directors of an institution must be qualified and reliable and devote sufficient time to the performance of their duties (section 25c (1) of the KWG). This also applies for the conduct of crypto custody business within the meaning of section 1 (1a) sentence 2 no. 6 of the KWG. A managing director’s lack of qualifications will constitute a ground for denial of authorisation (section 33 (1) no. 4 of the KWG).

Aside from the fact that lifelong learning is a MUST for leaders in our rapidly changing technology-driven environment, the crypto regulation Germany has opted for underscores an important point: “The crypto market has become and will remain an undeniable part of our financial system.”

It was a pleasure participating with other executives of innovation driving companies and banks at the 1st Crypto Custody Certificate Course offered by WM Seminare.

The well balanced equilibrium between theory and practise makes the course valuable. Especially the expert speakers as Dr. Carola Rathke ( Eversheds Sutherland ), Veronika (Vicky) Ferstl (TEN31 Bank AG ), Dr. Sven Hildebrandt ( DLC Distributed Ledger Consulting GmbH ), Martin Kreitmair ( Tangany GmbH ), Dr. Tim A. Kreutzmann, LL.M. (SUN) ( BVI Bundesverband Investment und Asset Management e.V. , Jacek Trzmiel ( Coinfirm ) & Christopher Zapf ( Tangany GmbH )