Hype, panacea, disruptor or partner?

by JOCHEN WERNE, April 4, 2018 – Original published in DER BANK-BLOG – Translated by DeepL

FinTechs offer innovative digital services, at a speed that traditional banks have difficulties to compete. What phases do these new technologies go through when they are introduced and what can banks learn from it?

Until recently, there were no alternatives to traditional banking – then FinTechs came along. In many cases, they claim nothing less for themselves than to have triggered a revolution in the financial sector. And there is no doubt that FinTechs, with their special offers and concept of initially approaching the problem from the customer’s point of view, free of regulatory and organisational considerations, are hitting the nerve of time. In addition, they show the pain points, i.e. the wishes of financial customers that have not yet been optimally satisfied. These are exactly the demands that have to be met in times of disruptive innovation.

The question of where this change should begin, with which project or projects is the decisive management question. It can be said in advance that this question cannot be answered in general, as too many components of the environment, orientation and corporate governance structure of the respective institution have to be taken into account.

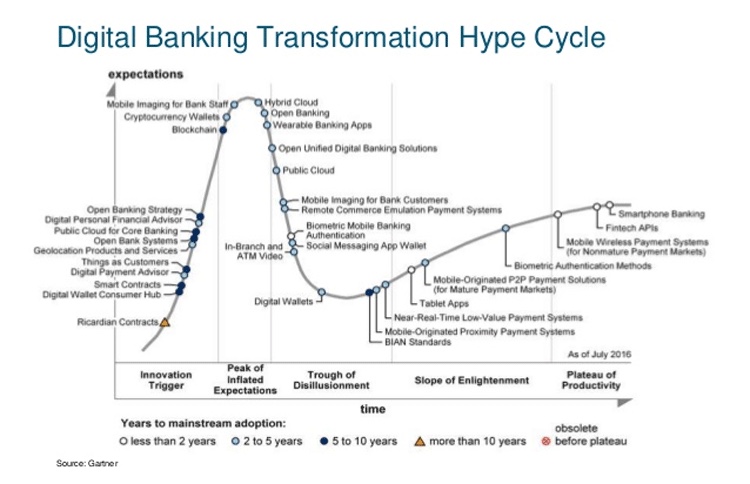

A look at Gartner’s Hype Cycle for Digital Banking Transformation can help the pre-strategy decision-making process. It looks at most future issues and arranges them along a curve that shows which phases of public attention a new technology goes through when it is introduced.

By means of a technological trigger, a specialist audience and other third parties begin to increase the level of awareness of an innovation or even just an idea for an innovation (on the rise). Expectations rise disproportionately and some time later they reach the peak of exaggerated expectations (at the peak). Since the creation of expectations progresses much faster than their fulfilment, a first disappointment is inevitable (sliding into the through). Then, in the so-called “path of enlightenment”, a realistic examination of the technology begins, in which lower media interest and productive deployment scenarios emerge (climbing the slope), which then lead to a plateau of productivity (entering the plateau) – if the technical innovation turns out to be relevant.

Gartner categorized in 2016 Digital Banking Transformation topics as follows:

On the Rise – Ricardian Contracts, Digital Wallet Consumer Hub, Smart Contracts, Digital Payment Advisor, Things as Customers, Geolocation Products and Services, Open Bank Systems, Public Cloud for Core Banking, Digital Personal Financial Advisor, Open Banking Strategy

At the Peak – Blockchain, Cryptocurrency Wallets, Mobile Imaging for Bank Staff, Hybrid Cloud, Open Banking Wearable Banking Apps

Sliding Into the Trough – Open Unified Digital Banking Solutions, Public Cloud, Mobile Imaging for Bank Customers, Remote Commerce Emulation Payment Systems, Biometric Mobile Banking Authentication, Social Messaging App Wallet, In-Branch and ATM Video, Digital Wallets, BIAN Standards, Mobile-Originated Proximity Payment Systems, Near-Real-Time Low-Value Payment Systems

Climbing the Slope – Tablet Apps, Mobile-Originated P2P Payment Solutions (for Mature Payment Markets), Biometric Authentication Methods

Entering the Plateau – Mobile Wireless Payment Systems (for Nonmature Payment Markets), FinTech APIs, Smartphone Banking

REMARK by the author: compare the 2018 situation in the Gartner study available HERE

Conclusions for incumbent banks

The listed topics should be familiar to every member of the management and the responsible managers in the area of strategic corporate development, as they can become key value drivers for the future orientation of your institute. The entrepreneur Brett King expressed it even more radically in his 2016 book “Augmented: Life in a smart world”:

“If you’re a bank, this is the year you start redesigning every single product in your wheelhouse.”

Brett King

Transparent fee structures and the simplest possible access to the banking system are basic requirements for customers. Whether FinTechs can offer sustainable business models in the long term remains to be seen. They, too, cannot escape the pressure on margins and changing customer demands. FinTechs make it easier for their customers to access the banking sector and can thus counteract the dissatisfaction of traditional bank customers in the service sector. They offer services where traditional banks often do not yet act flexibly enough. Established financial service providers are thus forced to rethink, adapt or further develop their business models. Those who escape this change will have to contend with major competitive disadvantages in the future.

About the author: Jochen Werne and the Munich based private bank August Lenz on-boarded five FinTechs within just one year. FinTech Finance wrote about the transformation "A bank becomes driver of innovation in digitalisation"