Article published in the Advance Magazine 01/2018

https://advance-online.de/zeitungen/advance-01-18/story/

Translated by DeepL

2012 Expedition “Cerberus”, day 3.

A workplace to fear. The wind whips the sailing yacht of the Global Offshore Sailing Team through the English Channel. The heating goes on strike, everything on board is clammy and ice-cold. Five men take turns on watch, the maximum rest period is three hours. Götz Gredé had been forewarned, had packed heaps of warm things and his father’s lined hunting boots. When he needs them, the rubber crumbles in his fingers. They were probably too old and simply dried up, the good pieces. For the guard on deck, Götz now has to slip into thin sneakers. He freezes like never before in his life, thinking only of escape. “In the next harbour I leave the ship. You don’t mind, do you?” he asks Jochen Werne. “Yes,” the expedition leader replies. Götz is speechless. Then he learns something for life.

1991: Gorch Fock.

Give up or hold out? Jochen Werne never asked himself this question. The wiry mid-forty grows with his tasks, that’s always been the case. He grew up in a village near Waldshut, directly on the Swiss border. At the station kiosk, where others stock up on grain, he buys the “Herald Tribune”. The view over the edge of the plate awakens the wanderlust. He is particularly fascinated by seafaring. He reports to the navy. There he belongs to the best, can choose his command. And he chooses one of the hardest jobs there is: the sail training ship “Gorch Fock”. 89 metres long, dream ship on the outside, life reduced to a minimum on the inside: 30 men on 30 square metres. Privacy only exists on the mast at a height of 40 metres. Werne has to sleep in the 1.75 metre long bunk. Werne measures 1.79 metres. “Turning around is not possible,” he says. “I never lay in a coffin, but I didn’t have much more room.” So it goes twice around the world.

What the navigator likes: sailing, camaraderie. What’s not: the bureaucracy and the inertia of the system. After two years duty on the “Gorch Fock” he decides against the officer career and studies business administration. Even today, Werne criticizes rigid, inefficient structures that do not fit into an ever faster society: “The bigger the company, the easier it is for me to hide behind bureaucratic processes. Do it on a ship!”

It turns out that shipping not only demands good leadership, it also provides strategic approaches when it comes to coping with disruption. “The Apollo 11 space capsule had 12,300 transistors, 3 billion fit on the processor of the Apple iPad Air 2.” Werne is enthusiastic about the exponential growth of digital technologies. “We live in the most prosperous time ever,” he says. His confidence has little to do with his belief in technology; it is based on a deeper insight: “We are all biased. Fears from childhood block our view of the positive.”

2017 London, Chatham House.

Take digitization, for example: “Of course many jobs will be lost,” says Werne, “but many will also be created. Nobody knows yet how big the gap between them will be. Is digitalization the biggest upheaval in human history? “That’s only what 30-year-olds say,” says Werne and laughs. It’s not a matter of worrying. After all, people are still the driving force behind technology. That also gives them the freedom to make their own decisions. For example, about what happens to that part of the population whose jobs are disappearing. Do we need a basic income? “Perhaps. But above all we need a plan,” says Werne.

Such plans are being discussed at Chatham House, for example, one of the world’s most important think tanks based in London. Jochen Werne discusses security, politics and society with the other members there. He also talks about the future of work: “We need contingency plans, otherwise high unemployment threatens and people lose their prospects,” he says. Above all, however, fear must be combated. It is important to illustrate the benefits of new technologies for people. Werne uses YouTube videos, for example, which show how Parkinson’s patients learn to control their trembling with the help of an implanted chip. Or a development of the world’s largest wine producer. At Gallo in California, all vines were equipped with sensors. They measure the moisture in the soil. This data is enriched with weather data from NASA satellites. “On this basis, Gallo was able to save 25 percent water during irrigation from one day to the next,” says Werne.

I FIRMLY BELIEVE IN MANKIND AND MORE IN ITS CREATIVE POWER THAN IN ITS DESTRUCTIVE POWER.

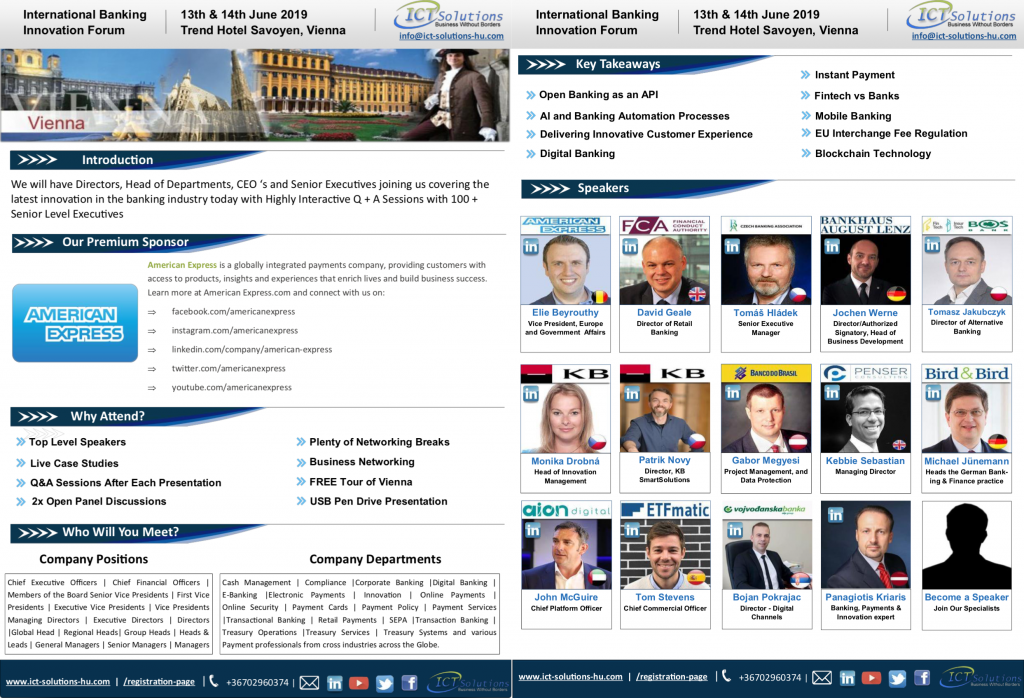

2003 Munich, Bankhaus August Lenz.

To see the future as a great adventure, this view of the world also brings momentum into professional life. After studying business administration, Jochen Werne worked at an Internet start-up, then became an analyst at Bankers Trust Alex. Brown International and in Global Investment Banking at Deutsche Bank. In 2001, he joined Accenture as a CRM specialist. His latest client there is the Mediolanum Group, an Italian financial services provider. In 2001 it took over the Munich bank August Lenz. Werne has been working for the “most personal private bank” since 2003, according to the promise in the slogan. As Director of Marketing, Business Development, Treasury & Payment Services, he drives the bank’s digitization. He also deliberately seeks cooperation with up-and-coming Fintechs and develops services for which the bank has already received several awards. “Innovation must start with top management,” he says. His strategy: “Bring the right people together, then make it easy. Werne borrows a nice term for this from Erich Fromm: “spontaneous activity”. “Spontane is important, it brings in creativity,” he says. The concept “9 to 5” is dead, in new working environments it is exactly about making it as easy as possible for employees to come up with ideas. Hierarchies are indispensable, says Werne. Not only when sailing. But he does restrict: “If the hierarchy stands, you also have to delegate and trust. I’ve never seen anyone fail to accept a task assigned to them.”

2012 Expedition “Cerberus”, day 3.

Which brings us back to the freezing Götz Credé. “He was completely perplexed because I didn’t want to just let him leave the boat,” recalls Werne. In the conversation he draws a clear line: “We are in an uncomfortable situation, not in a struggle for survival. Then he outlines a possible future for his colleague: “If you give up, you’ll always find plenty of reasons to justify yourself. People will agree with you. But that’s not the point. It’s about admitting to yourself: “I can’t do that.” When the next similar situation comes, you will behave like that again. And in the end you walk stooped through life.” Götz Credé stays and is the first one to sign up for the next tour. Jochen Werne says: “The strongest drive comes from within. Life is always about answering three questions: “What do I want?”, “What does it cost me?” and “Am I willing to pay the price?

Werne recommends all those who don’t feel comfortable at work to answer these questions for themselves. He focuses on personality and freedom in the search for talent: “You can no longer reach the target group with the classic job description,” he says. It is more important to appear authentic and to enable employees to shape their own work. Only in this way can a company be successfully managed, because: “The well-being and woe always depends on the people”.

AS SOON AS THE HIERARCHY IS SET, ONE MUST ALSO BE ABLE TO DELEGATE AND TRUST.

2017 Prologue.

Jochen Werne likes to digress when he talks. Always in an honest effort to leave the visitor in the dark about nothing. The world is complicated. Jochen Werne thinks deeper than many others. The visitor experiences a doer with brains, an adventurer with a plan. Oh what, with many plans. Sovereign in appearance, blessed with the ability to get enthusiastic about one thing and carry others along. The most beautiful example: In 1999 Jochen Werne founded the international Global Offshore Sailing Team (gost.org) to combine two passions: sailing on the high seas and international understanding. 30 to 40 members from different nations belong to the crew in changing line-ups. “There are no national differences at sea, especially in extreme situations,” says Werne. And these are the result in the following years, from the fight against storm and ice in Spitsbergen to the machine breakdown in the English Channel. The machine is repaired by the expedition leader himself, although he actually has no idea about the matter. He thinks, analyses, finally finds the blocked cooling circuit and cleans it. There was simply no one else there who could have done it better. The banker, future thinker and expedition leader Jochen Werne trusts himself quite naturally. In the end, we have the impression that with self-confidence, experience and a thirst for adventure, the future can not only be mastered, but well shaped.

Antarctica 2018: “Mankind can do a lot!

One of the expeditions led by Jochen Werne led to the Arctic ice in 2016. The GOST team sailed to the pack ice border in the footsteps of researchers like Roald Amundsen, Fridtjof Nansen and Ernest Shackleton. It commemorated the seamen who fought in the battles for Arctic convoys with supplies for Russia in the Second World War between 1941 and 1943. In the name of Norway and Canada, the expedition participants handed over wreaths of the sea in memory of the fallen. At the same time, the expedition was to raise awareness of the effects of climate change on the Arctic. The expedition team was supported by King Harald of Norway, the Canadian government and Chancellor Angela Merkel.

In February 2018, Jochen Werne set course for Antarctica. “This is a completely different story again,” he says. The average temperature on the coldest continent is minus 30 degrees, and the ice layer is on average 2.1 kilometres thick. The “Antarctic Blanc” expedition primarily serves the environment. The “Antarctic Treaty” has been in force since 1961, an agreement between 30 countries that have committed themselves to refrain from using Antarctica for military purposes and to exchange their research results openly. In 1998, the “Environmental Protocol” was also signed, which is considered the toughest environmental protection agreement in the world. Werne is optimistic: “It shows that we as humanity can achieve a lot, regardless of what opinions we hold.

The importance that the GOST expeditions now enjoy was already apparent in advance. Support came from the Queen of England, the Vienna Hofburg and the office of the German Federal President. The heads of state of the Czech Republic and Finland sent personal letters, Belgium, Bulgaria, Sweden and Switzerland were also on board. Jochen Werne manages this with months of dedication and the motto: “If you want to achieve something – always start at the top”.

The expeditions on the web:

Global Offshore Sailing Team: www.gost.org

Arctic Expedition 2016: www.arcticoceanraptor.com

Antarctic Expedition 2018: www.antarcticblanc.com

Bankhaus August Lenz: www.banklenz.de