THE EVENT

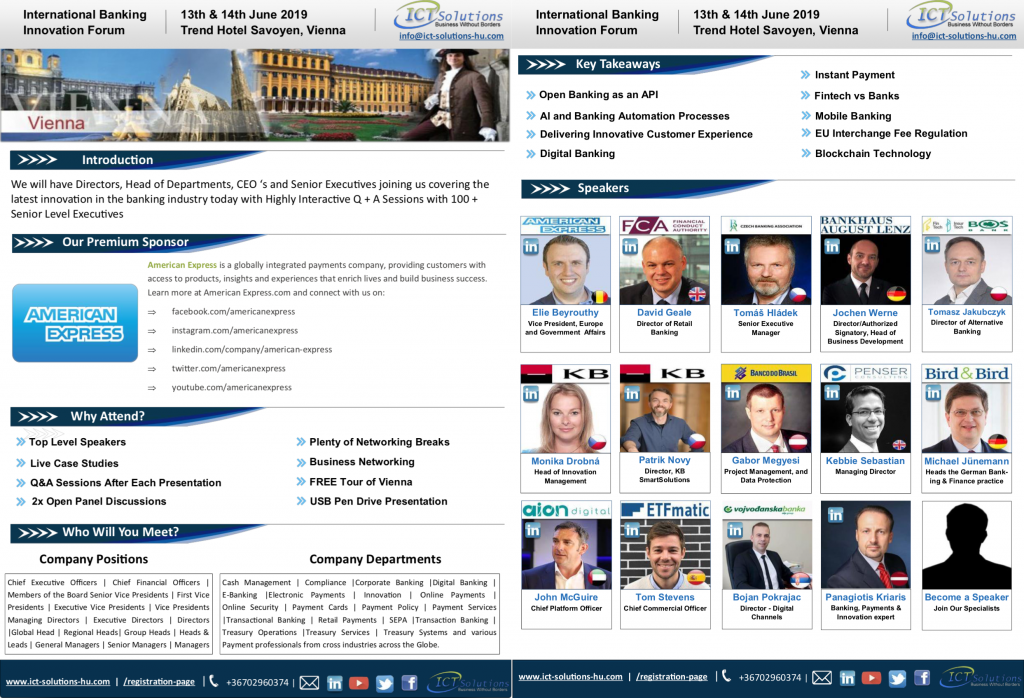

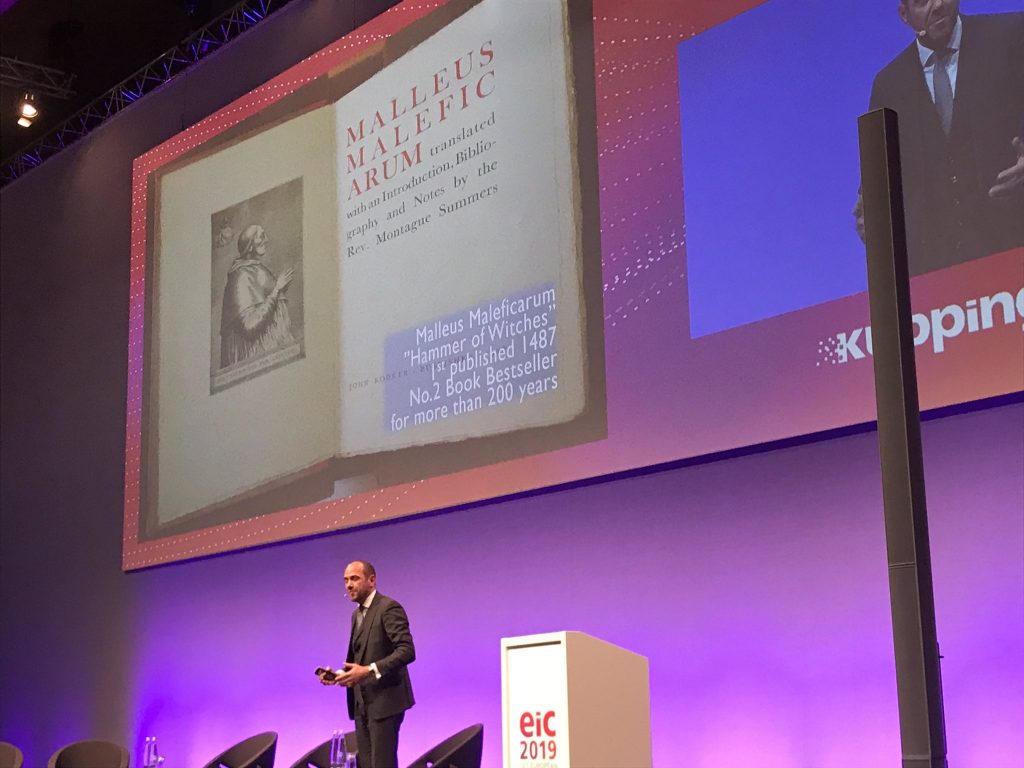

The speaker this morning is Jochen Werne, a graduate banking and marketing specialist. As director and authorized signatory, he is responsible for private banking and corporate banking at Bankhaus August Lenz & Co. AG in Munich. He is guest lecturer at universities and colleges, keynote speaker at banking and innovation conferences, author and co-author of books and articles on leadership, innovation, KI, FinTechs, Cyber Security and much more. He is a member of the platform for artificial intelligence “Learning Systems” initiated by the Federal Ministry of Education and Research and advising the German Federal Government as well as of the Royal Institute of International Affairs Chatham House, ambassador of the Peter Tamm sen. foundation and is listed by Focus-Magazin as one of the AI experts in Germany. He is the founder of the Global Offshore Sailing Team GOST and co-founder of the NGO Mission4Peace, which is dedicated to historical research, building international diplomatic relations and promoting international dialogue.

The participants will also get to know the Diplomatic Council (DC) this morning. It combines a global think tank, a business network and a charity foundation in a unique organization with consultative status at the United Nations. Stephanie Stoerk, Chapter Director DC Stuttgart, explains what distinguishes the Diplomatic Council from all other networks and what advantages it offers its members.

Breakfast is open from 8:30 am. At 9:00 a.m. we start our official program (whoever comes earlier has time to eat in peace), which lasts until 10:30 a.m. (including questions and answers). In between there is always the possibility to eat from the rich breakfast buffet.

Translated with www.DeepL.com/Translator

PROGRAMM

Der Redner an diesem Morgen ist der diplomierte Banking- und Marketing-Spezialist Jochen Werne. Er verantwortet als Direktor und Prokurist das Private Banking sowie den Corporate Banking Bereich bei der Bankhaus August Lenz & Co. AG in München. Er ist Gastdozent an Universitäten und Hochschulen, Keynote Speaker auf Banking- und Innovationskonferenzen, sowie Autor und Co-Autor von Büchern und Artikeln zu Leadership, Innovation, KI, FinTechs, Cyber Security u. v. m. Er ist u. a. Mitglied der vom Bundesministerium für Bildung und Forschung initiierten und die deutsche Bundesregierung beratende Plattform für Künstliche Intelligenz „Lernende Systeme“ sowie des Royal Institute of International Affairs Chatham House, Botschafter der Peter Tamm sen. Stiftung und wird vom Focus-Magazin als einer der KI-Experten in Deutschland geführt. Er ist Gründer des Global Offshore Sailing Teams GOST und Co-Founder der NGO Mission4Peace, die sich der historischen Forschung, dem Aufbau internationaler, diplomatischer Beziehungen sowie der Förderung eines internationalen Dialogs widmet.

Darüber hinaus lernen die Teilnehmer an diesem Morgen das Diplomatic Council (DC) kennen. Es verknüpft einen globalen Think Tank, ein Business Network und eine Charity Foundation in einer einzigartigen Organisation mit Beraterstatus bei den Vereinten Nationen. Stephanie Stoerk, Chapter Director DC Stuttgart, informiert, was das Diplomatic Council von allen anderen Netzwerken unterscheidet und welche Vorteile sich daraus für die Mitglieder ergeben.