Keynote take-away at the EUROFORUM Deutschland GmbH #HAFTPFLICHT20 Conference:

“Transformation is the new normal case in times of exponential technology steps and artificial intelligence”

Jochen Werne

https://lnkd.in/dyGTH7W

Keynote take-away at the EUROFORUM Deutschland GmbH #HAFTPFLICHT20 Conference:

“Transformation is the new normal case in times of exponential technology steps and artificial intelligence”

Jochen Werne

https://lnkd.in/dyGTH7W

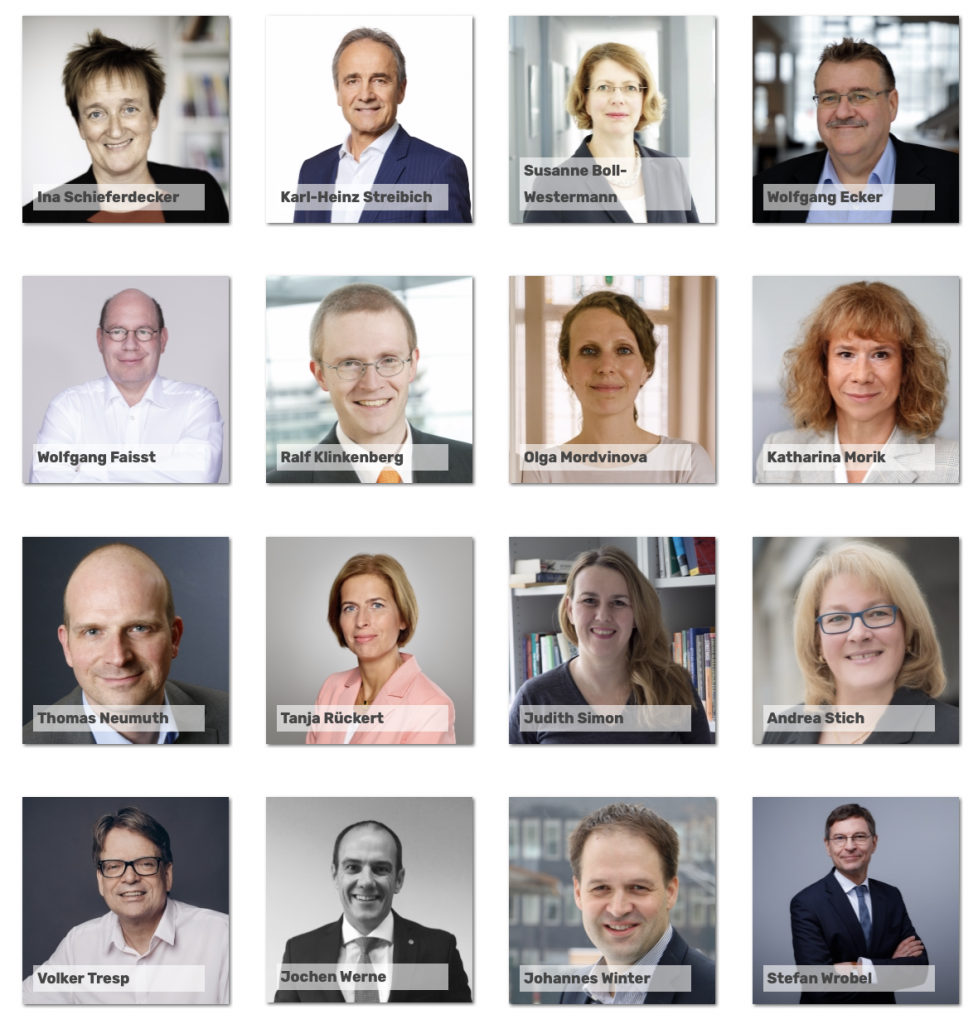

It’s a great pleasure supporting on October 28, this year’s DIGITAL SUMMIT together with other experts from the “Platform Learning Systems, the Platform for Artificial Intelligence” #DigitalGipfel19 #platformeconomy

The Digital Summit (previously the National IT Summit) and the work that takes place between the summit meetings form the central platform for cooperation between government, business, academia and society as we shape the digital transformation. We can make best use of the opportunities of digitisation for business and society if all the stakeholders work together on this.

The National IT Summit was renamed the Digital Summit in 2017. This was to take account of the fact that digitalisation comprises not only telecommunications technology, but the process of digital change in its entirety – from the cultural and creative industries to Industrie 4.0.

The Digital Summit aims to help Germany to take advantage of the great opportunities offered by artificial intelligence whilst correctly assessing the risks and helping to ensure that human beings stay at the heart of a technically and legally secure and ethically responsible use of AI.

The Digital Summit looks at the key fields of action within the digital transformation across ten topic-based platforms. The platforms and their focus groups are made up of representatives from business, academia and society who, between summit meetings, work together to develop projects, events and initiatives designed to drive digitalisation in business and society forward. The Summit will serve to present the results of the work that has been done in the past, to highlight new trends and discuss digital challenges and policy approaches.

Looking forward moderating the Panel Discussion on “Digital Platforms for new AI-based Services”

by Katharina Schneider – Handelsblatt, 21 August 2019 –

“It has been inspiring discussing with Katharina Schneider about AI and the future of the financial sector and being quoted in her article among other experts as Prof. Andreas Dengel (DFKI), Dirk Elsner (DZ Bank) and Nils Beier (Accenture) . Read the original article here“

Jochen Werne

Frankfurt The interplay between artificial intelligence and the financial sector in Great Britain will soon be very vivid: from 2021, the portrait of Alan Turing will adorn the new 50 pound notes. The scientist is known for his early research on computer technology. (translated with DeepL.com)

Read the original article here

25. JULY 2019 BY JULIANE WAACK – KEYNOTE BY Jochen Werne

For the opening keynote of our ec4u virtual conference Digital Thoughts on May 23rd, Jochen Werne, Director Marketing & Authorised Officer at Bankhaus August Lenz, talked about opening up to the digital transformation. It turns out, what we associate with technology and what it actually offers are often two completely different things.

„Companies and people need to participate actively in the transformation. We need to move. It’s impossible to be a passive participant in the transformation.“

J. Werne

Jochen Werne, Director Marketing & Business Development at Bankhaus August Lenz, explains in his keynote address how we can shape the future from the innovations and topics of the past and why digitization must be thought of not only technologically but also culturally.

Jochen Werne, Direktor Marketing & Business Development beim Bankhaus August Lenz, erläutert in seiner Keynote, wie wir aus den Innovationen und Themen der Vergangenheit in der Gegenwart die Zukunft gestalten können und warum Digitalisierung nicht nur technologisch, sondern auch kulturell gedacht werden muss.

Artificial intelligence is the new buzz word of the financial industry, says Jochen Werne. In view of the rapid pace of technological development it is becoming a source of hope for the banks – and rightly so, writes the author. After all, banks have an enormous amount of data at their disposal. Despite all the digitalisation and areas of application of AI, Werne sees the chance for a renaissance of consulting as a link between people and the technical world. Red. Bank und Markt

Read the full article in the new June 2019 edition of BANK und MARKT here

German: Künstliche Intelligenz ist das neue Buzz-Wort der Finanzbranche, sagt Jochen Werne. Angesichts der rasanten technologischen Entwicklung wird sie zum Hoffnungsträger für die Banken – zu Recht, meint der Autor. Schließlich verfügen Banken über einen enormen Datenschatz. Trotz aller Digitalisierung und Einsatzbereiche von KI sieht Werne jedoch die Chance auf eine Renaissance der Beratung als Bindeglied zwischen Mensch und technisierter Welt. Red.

Jochen Werne is full-time Director & Authorized Officer for Bankhaus August Lenz & Co. AG of the Mediolanum Banking Group and is responsible for Business Development, Marketing, Product Management, Treasury & B2B Payment Services. In addition, he is involved in the development of non-profit organizations and a member of the Learning Systems Platform of the Federal Ministry of Education and Research.

The initiative www.wegofive.net addresses the question of how a unit of man and machine can be created in the working world of tomorrow and how algorithms can be seamlessly integrated into the organization in order to supplement the capabilities of employees.

In this first, introductory part of our interview Jochen gives us an insight into what has changed for him in the last decades – and he finds out that “Hamburg is probably the most beautiful city in Germany” 😉

As an independent interim manager, profile and team coach, Sascha Adam supports people, decision-makers and companies in actively shaping digital change.

More at www.wegofive.net/mission/about or www.sascha-adam.net.

Many thanks to the coast by east Hamburg in the Hafencity Hamburg for the permission to film here. A very recommendable location with obliging service, extraordinary menu and good drinks. Apropos, the background noises also give you the feeling of sitting directly with us 😉

Jochen Werne ist hauptberuflich Director & Authorized Officer für das Bankhaus August Lenz & Co. AG der Mediolanum Banking Group und verantwortet dort die Bereiche Business Development, Marketing, Product Management, Treasury & B2B Payment Services. Darüberhinaus ist er am Aufbau gemeinnütziger Organisationen beteiligt und Mitglied der Plattform Lernende Systeme des Bundesministerium für Bildung und Forschung. Die Initiative www.wegofive.net geht der Frage nach wie in der Arbeitswelt von morgen eine Einheit aus Mensch & Maschine geschaffen werden kann und sich Algorithmen nahtlos in die Organisation integrieren, um die Fähigkeiten der Mitarbeiter zu ergänzen. In diesem ersten, einleitenden Teil unseres Interviews gibt uns Jochen einen Einblick was sich in den letzten Jahrzehnten für ihn verändert hat – und stellen fest, dass “Hamburg die wahrscheinlich schönste Stadt in Deutschland ist” 😉 Sascha Adam unterstützt als selbstständiger Interimsmanager, Profile- und Team-Coach Menschen, Entscheider und Unternehmen dabei den digitalen Wandel aktiv zu gestalten. Mehr unter www.wegofive.net/mission/about oder www.sascha-adam.net. Ganz herzlichen Dank an das coast by east Hamburg in der Hafencity Hamburg für die Genehmigung hier filmen zu dürfen. Eine sehr zu empfehlende Location mit zuvorkommender Bedienung, außergewöhnlicher Speisekarte und guten Drinks. Apropos, die Hintergrundgeräusche geben einem auch gleich das Gefühl direkt bei uns zu sitzen 😉

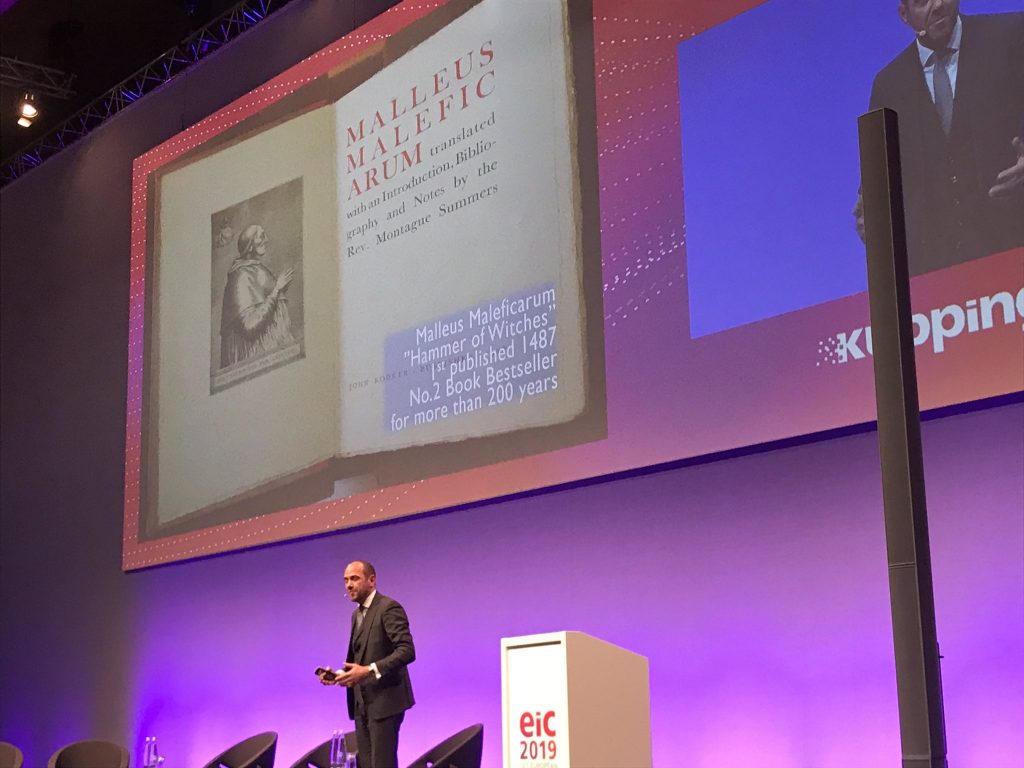

It has been greatly inspiring giving a keynote on the impacts of AI on business and society and to discuss with some of the 800 thought leaders, leading vendors, analysts, visionaries and executives at the highly recognised Kuppinger Cole European Identity & Cloud Conference 2019.

Jochen Werne

Find more inspiring keynotes from the #EIC19 here

HANDELSBLATT KI-SUMMIT

DETAILS & LINK TO THE SUMMIT

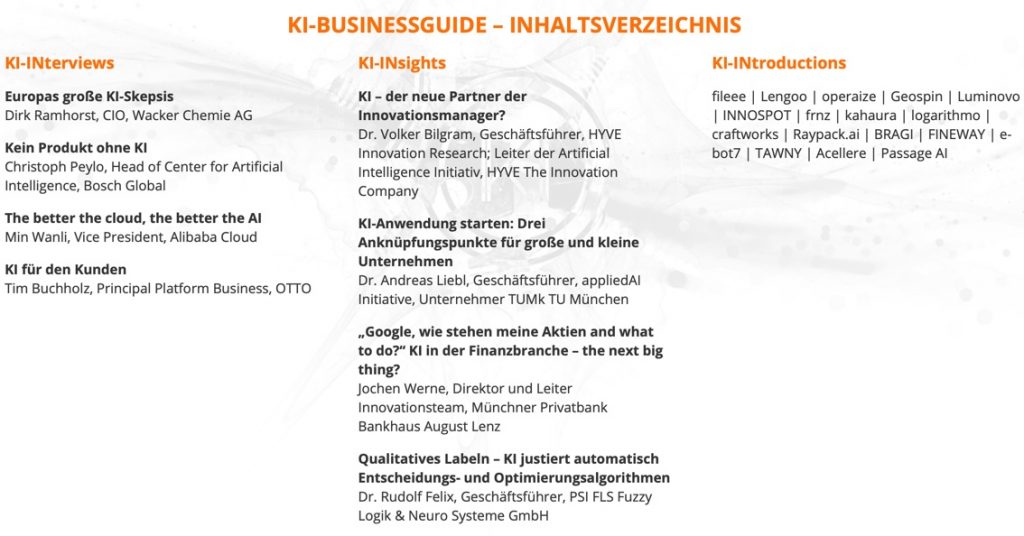

Read interviews and articles from experts in the KI-Businessguide published by the Handelsblatt for the Summit and free to download on this website

Artificial intelligence is finding its way into the highly regulated world of banking. And not only GAFA Silicon Valley high-tech companies see it as the technology of the future, but also FinTechs and established banks. How it came to this, what possibilities and limits there are at the moment and why humans will remain irreplaceable not only when it comes to money – the commentary

by Jochen Werne, innovation and transformation expert

Munich private bank Bankhaus August Lenz

Original published in German in the IT-Finanzmagazin (31 July 2018). Translation by DeepL

After “FinTech”, “Blockchain” and “Crypto”, “AI” is the new buzzword in the banking world. Whether chatbots in the digital customer center or self-learning algorithms for highly complex investment strategies are being discussed – the omnipresence of the term suggests that the integration of artificial intelligence into one’s own business model seems to be virtually vital.

Artificial intelligence and big data are currently the strongest and most vibrant innovation trends in the financial sector …

… was also one of the guiding principles of Prof. Joachim Wuermeling, board member of the Deutsche Bundesbank, in his speech on “Artificial Intelligence” at the second annual FinTech and Digital Innovation Conference in February 2018 in Brussels.

The choice of the conference venue, which like rarely any other city combines both a belief in progress and a deeply rooted European tradition, can hardly be more symbolic of the forthcoming change. In fact, the topic is by no means new: the development towards an increased use of so-called non-human intelligence is based on approaches from the 1940s – with the invention of the first computers

Artificial intelligence: revolution as a reaction to mountains of data?

But what is now possible in times of exponential technologies is in fact nothing less than a revolution. The financial industry is sitting on a valuable mountain of data, the extent of which is currently difficult to estimate. The maturing AI systems would not only make the preparation and processing of this data easier, but also much more cost-effective, faster and more targeted. Data already collected could become the most valuable raw material and a resource due to the technological leaps in the field of AI, which, in combination with the enrichment of external, non-structured data, must be “usable” in a meaningful way.

The industry is asked to use private data in a sensitive way for the benefit of the customer, – a goal that should certainly apply to all AI-based approaches.

To find meaningful regulations for the handling and the effects of the use of AI on society, economy and thus on our life and the work of tomorrow is the task of politics. The fact that this topic is taken very seriously is evident not only in national initiatives such as the German Platform for Artificial Intelligence “Learning Systems”, but also in the European Artifical Intelligence shoulder-to-shoulder approach, which is being pushed forward by France and Germany.

“Digital hand holding” in the event of a financial crash is not enough

At present, it is still too early to say which operational areas of the financial world will sooner or later be supported – in part or even entirely – by the use of AI systems. However, the financial crises of the past have shown this time and again:

Trust is crucial when it comes to money. Trust in the markets, the banking system and the human contact as an intermediary in a complex issue”.

However, the banking industry knows very well from its own experience how easy it is to loose customer’s trust. An experience that Mark Zuckerberg and Facebook recently also had to make in connection with the Cambridge-Analytica scandal. As with every new technology and every new approach, the same applies to the topic of “intelligent” systems: a lot of trust, coupled with half-knowledge and a big dash of emotionality results in a popular trend cocktail, which, however, bears a certain risk of headaches on the following day.

Jochen Werne is the authorized signatory responsible for Marketing, Business Development, Product Management, Treasury and Payment Services at Bankhaus August Lenz & Co. After two years as navigator of the sailing training ship ‘Gorch Fock’, the international marketing and banking specialist completed his studies as client coverage analyst at Bankers Trust Alex. Brown International and in Global Investment Banking at Deutsche Bank AG, he has worked on numerous projects in other European and American countries. In 2001, he joined Accenture as a Customer Relationship Management Expert in the Financial Services Division before joining Bankhaus August Lenz & Co. AG in Munich, where he has since been responsible for various areas of the institute. As part of the Innovation Leadership Team of the Mediolanum Banking Group, a member of the expert council of Management Circle and the IBM Banking Innovation Council, Jochen Werne is a keynote speaker at numerous banking and innovation conferences.