The rise of AI and ML in fraud prevention can lead to a new era of digital trust and compliance

Author: Jochen Werne / 26.12.2023

Author: Jochen Werne / 26.12.2023

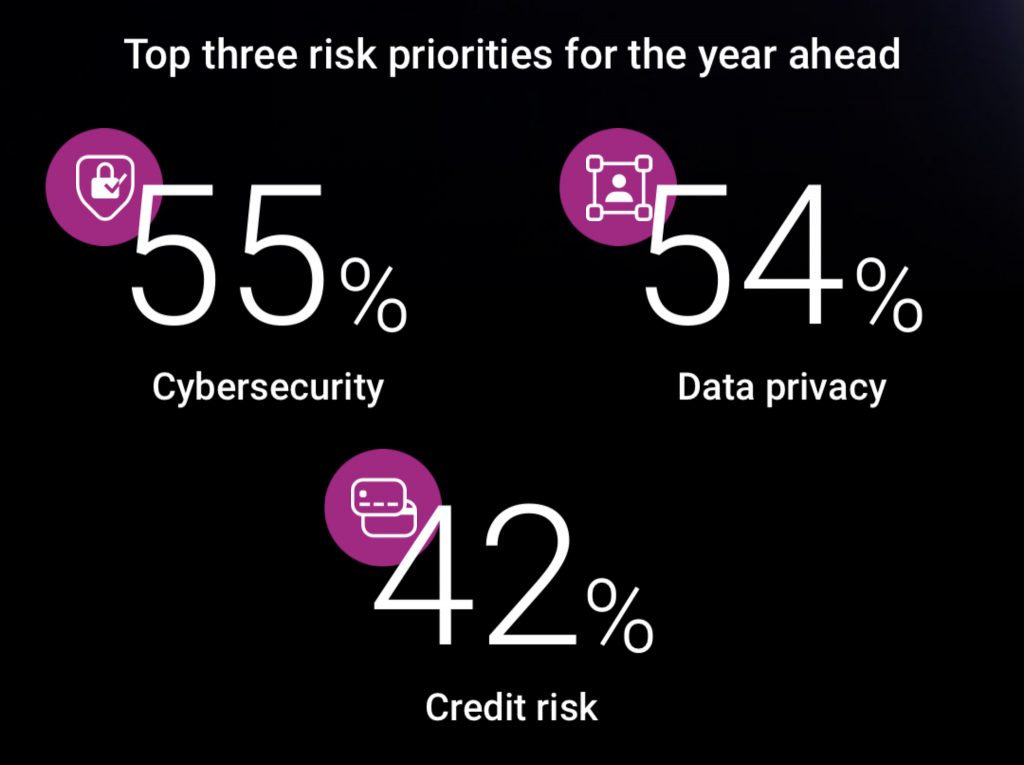

In an era marked by rapidly advancing technology and increasing global interconnectivity, the fight against online fraud has become a paramount concern for financial institutions, businesses, and regulators worldwide. Part of my professional work revolves around understanding and mitigating the risks associated with financial fraud. The Experian Forrester Fraud Research Report 2023, which was recently released, sheds light on the escalating threat of online fraud and the evolving strategies to counter it, particularly through the use of Machine Learning (ML) and Artificial Intelligence (AI).

The report’s findings are stark: a 74% increase in fraud losses in Germany, reflecting nearly the global increase rate. This surge is not just a statistic; it’s a clear indication of the sophisticated and pervasive nature of modern financial fraud. Companies across various sectors are feeling the impact, with financial services bearing the brunt. This trend is deeply concerning not only for the economic health of individual businesses but also for the broader stability and security of the financial system.

From a geopolitical perspective, the rise in online fraud is a multifaceted challenge. It’s a threat that transcends borders, affecting relations among nations, and has become a significant factor in international policy and security discussions. Countries, including Germany, are increasingly recognising the need for cooperative international efforts to combat this scourge. The geopolitical implications are profound, as fraud undermines economic stability and erodes public trust.

Turning to the German banking sector, the issue of compliance and reputation risk under the framework of Minimum Requirements for Risk Management (MaRisk) is particularly pertinent. Banks are finding themselves at the forefront of the battle against online fraud, necessitating robust risk management strategies that align with regulatory requirements. Under MaRisk, the mandate is clear: implement effective, comprehensive controls to detect, prevent, and manage fraudulent activities. The reputational risk for banks and their board members is immense; a single lapse can lead to significant financial losses, legal consequences, and lasting damage to customer trust.

In this challenging landscape, AI/ML-based fraud prevention methods stand out as beacons of hope. These technologies offer the promise of enhancing detection capabilities, reducing false positives, and adapting swiftly to new fraudulent tactics. However, their implementation must be undertaken with a clear understanding of the ethical implications and potential biases inherent in AI systems. As we embrace these technologies, we must also commit to transparency, accountability, and continuous improvement to ensure they serve the interests of all stakeholders fairly and effectively.

Despite the challenges, I believe there is a path forward that balances the need for security with the imperative for innovation and growth. The key lies in embracing a multi-faceted approach to fraud prevention that leverages the best of technology, human expertise, and regulatory compliance. ML, with its ability to learn and adapt to new patterns, offers a powerful tool in this fight. However, its effectiveness hinges on the quality of data, the integrity of algorithms, and the wisdom of the humans who guide its evolution.

The German companies surveyed in the study are acutely aware of the challenges and opportunities presented by AI/ML in fraud prevention. The overwhelming majority recognise the efficacy of ML-based approaches and anticipate their increasing dominance in the field. Yet, they also acknowledge the hurdles, including the costs associated with deploying advanced fraud prevention solutions, the need for continuous adaptation, and the importance of addressing the ethical considerations of AI use.

In my experience, one of the most critical factors for success in this endeavour is collaboration. Tackling online fraud is a collective effort that requires the involvement of businesses, regulators, technology providers, and consumers. By working together, sharing knowledge, and fostering a culture of innovation and vigilance, we can stay ahead of fraudsters and protect the integrity of our financial systems.

Another vital aspect is education and awareness. Both consumers and employees must be informed about the risks of online fraud and the steps they can take to prevent it. Regular training, robust policies, and a culture of security are essential in creating a resilient defense against fraud.

Finally, we must recognize that the fight against fraud is an ongoing battle. As technology evolves, so too will the tactics of fraudsters. We must remain agile, constantly updating our strategies, investing in new technologies, and adapting to changing regulatory landscapes. This dynamic approach is not just about defense; it’s about building a stronger, more secure future for everyone.

The Experian Forrester Fraud Research Report 2023 is a call to action. It highlights the urgent need for enhanced strategies, stronger collaboration, and a steadfast commitment to ethical, innovative solutions in the fight against online fraud. As leaders in the financial services industry, we have a responsibility to take the helm, steering our organisations towards safer waters in this tumultuous sea of digital threats. By harnessing the power of AI/ML, prioritising ethical considerations, and fostering a culture of collaboration and continuous learning, we can not only mitigate the risks of online fraud but also pave the way for a more secure, prosperous, and trustworthy financial ecosystem.

#fraudprevention #dataliteracy #machinelearning