What role does humans play in times of exponential technological developments and how does this influence our society?

Author: Jochen Werne / first published May 2019 @LinkedInPulse

Siri or Alexa? Who can offer us more help in our daily life? Who provides the better answers and leads the more eloquent conversation? A legitimate question, because both Smart Devices are now so technically mature that it is difficult to make a simple distinction. Alexa was only launched in November 2014 in the USA and at the end of October 2016 in Germany.

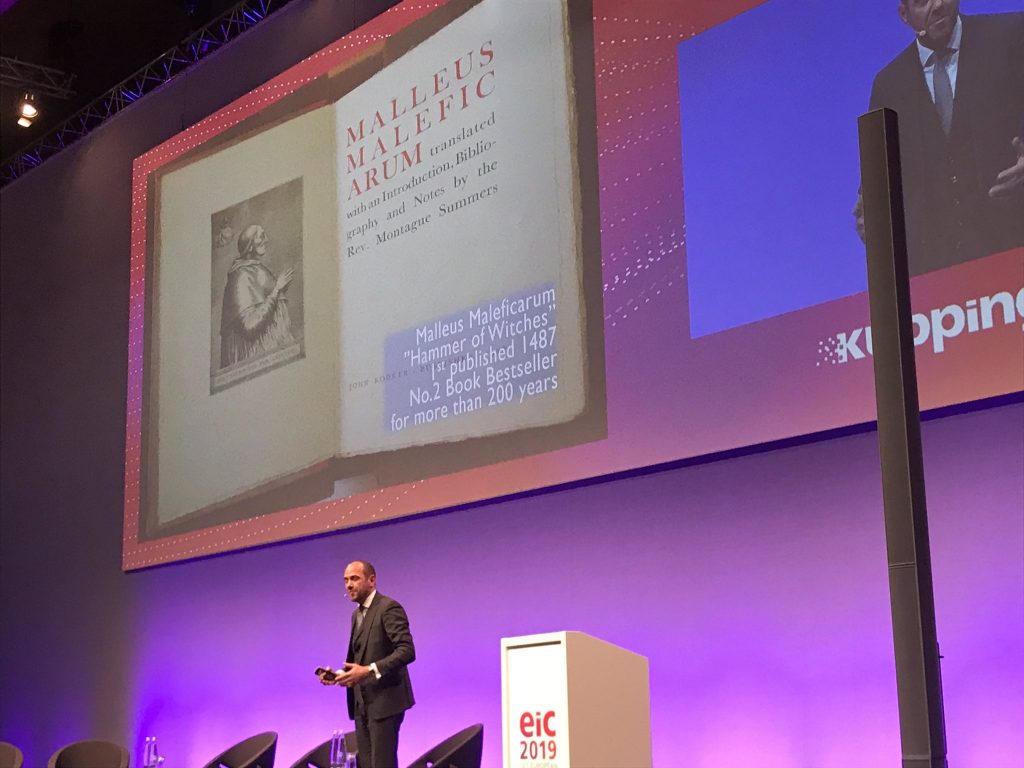

Our world is changing from analogue to digital. While the invention of the printing press in 1450 by Gutenberg was a true milestone on the timeline of human development, we now live surrounded by smartphones and cloud applications in which we can store, share and retrieve even the most private information from anywhere in the world. Smart support is omnipresent: Siri accompanies us through everyday life in the form of Apple products and Alexa awaits us – Amazon powered – with a familiar voice when we get home. The intelligent speech assistance systems are only one of many modern applications of Machine & Deep Learning technologies and are therefore more broadly defined by artificial intelligence. With the extremely dynamic and rapid development of smart robotics and learning systems, some people are asking themselves what role humans will play on the stage of these technologies in the future.

The emerging technological possibilities, like all technological achievements in the past, have an impact on our daily personal lives, but their potential unfolds when we consider this impact in a scaled way and when it comes to our society as a whole. The Tübingen professor of media science, Bernhard Pörksen, even speaks of the fact that we have long since been able to be described as a “digital society” – this change took place in an extremely short time and without us being prepared for it. As a result, we would first have to learn competences to understand our actions in this new digital world and also to learn how to deal with the resulting effects. The learning of these skills takes place at different speeds in the case of digitisation issues, even against a demographic background. In contrast to the digital natives of the 21st century, some parts of our population with fewer points of contact with digital media find it more difficult to deal with the challenges of new technological standards and to adapt to the changed conditions in the service sector. The efficiency of the technical possibilities that permeate all areas of our lives is impressive, but it is crucial for success in the service sector not to ignore one factor: human empathy.

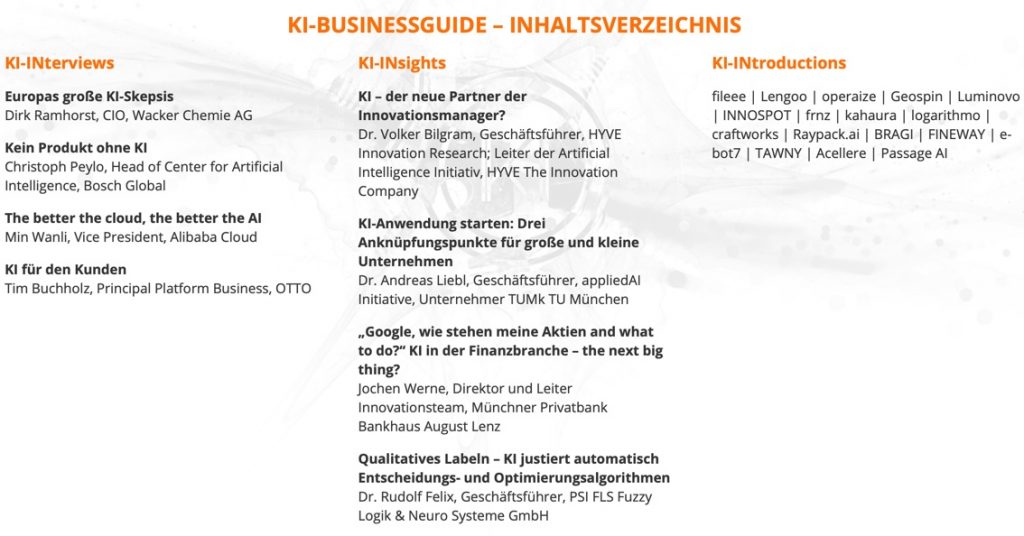

An example of this is the financial sector. Your own money is an issue that most people are most personally concerned about. However, plagued by fears of loss, personal biases and an extremely complex oversupply of investment alternatives, many investors seek personal support that goes beyond enumerating facts. We are talking about human support and empathic accompaniment, which machines (so far) have not been able to provide. A service that ideally covers not only the technical aspects of financial consulting, but also the behavioural finance aspects.

Undoubtedly there are already developments like Google Assist, in which attempts are made to incorporate empathic components into the developments, but the ability of the machines to simulate emotions and accordingly cause emotional reactions in humans (still) reaches its limits.

The upcoming technological developments will help us to solve many hitherto unsolvable problems in e.g. medicine, in environments hostile to humans or in a World Food Programme in a relatively short time. But as always with new technologies, it is also important to limit the abusive possibilities of use and to educate population that have little contact with modern instruments and technologies, because otherwise there is the danger of creating a feeling of inequality, which in turn can lead in extreme cases to a division of society. The desired progress would thus be reversed into its opposite: a step backwards based on a lack of communication at the micro and macro levels.

“It will certainly be our task in the future to ensure that developments in technological progress, artificial intelligence and the role of man go hand in hand. To advance optimizations through technology and digitization, as well as a parallel enlightenment of the individual with regard to his uniqueness in relation to technological development, as well as his social responsibility in this context.”

Jochen Werne

The following comparison should simplify the problem between strengths and limitations of automated systems: In 2012 an autopilot would probably not have let the Costa Concordia collide with a rock – the reason was human, emotionally driven behaviour. But an autopilot could not have landed an Airbus 320 on the Hudson River in 2009 either. This required human experience and spontaneous creativity. Something that our brain can do, but that still allows the technical possibilities of AI to reach hard limits for the foreseeable future.

It remains to be said that smart devices like Alexa and Siri provide valuable support and even provide entertainment with the increasingly mature question-and-answer game. We can ask the digital companions anything. We also get – within the scope of technical possibilities – a cheeky answer. But we have to deal with the extent to which these answers provide us with what we expect, also on an emotional basis. Because our expectations often go beyond a technical answer.

More in-depth insights on this topic can be found, for example, at the Platform for Learning Systems (https://www.plattform-lernende-systeme.de/home.html ).