Andaman Sea Beach Cleaning

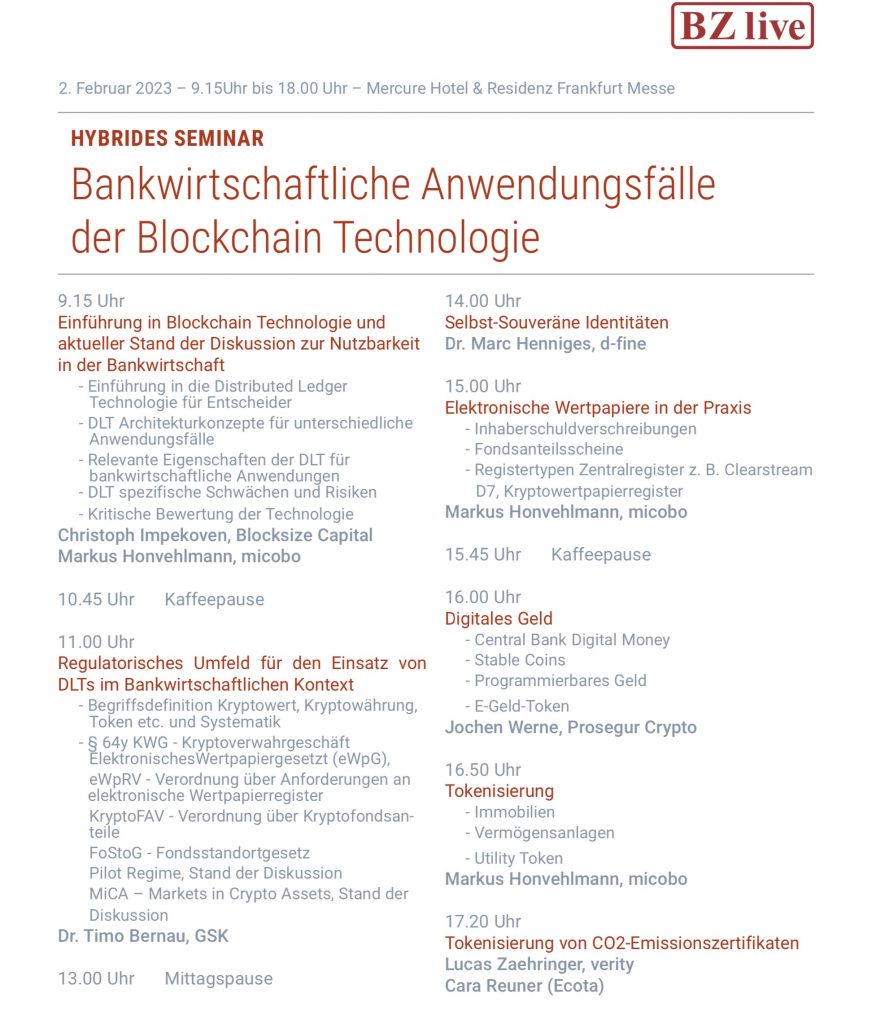

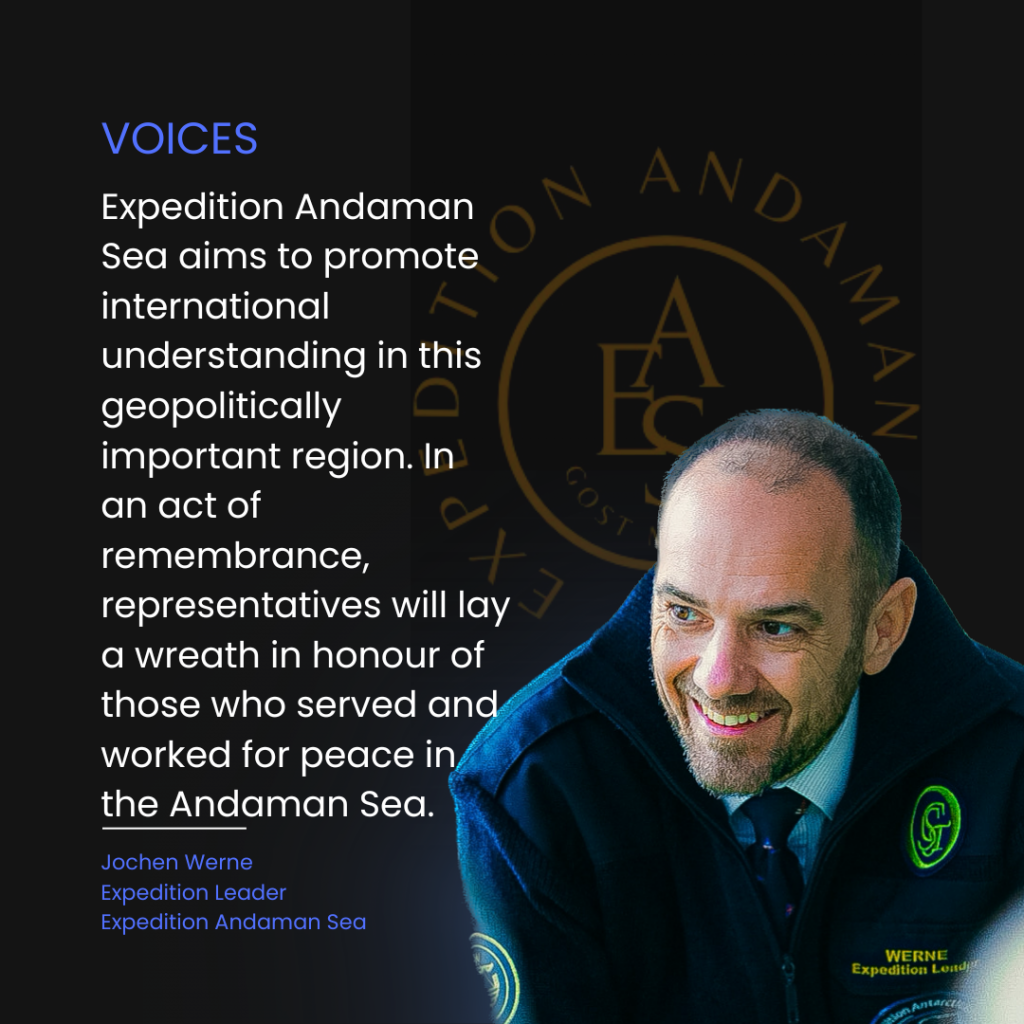

Following the inspiring examples of only.one, beachcleaner.de, blue-awareness.com and many others, the Global Offshore Sailing Team also followed its long-standing tradition of standing up for the sea by supporting UNEP’s Global Goals during Expedition Andaman Sea 2023. The Expedition Corps consisted of Guido Zoeller, Jochen Werne, Benon Janos, Marco Schroeter, Sascha Adam, Sven O. Mueller, Sven Streiter, Christoph Impekoven and Viktor Metz.

On 19 April 2023, the team landed on the remote tiny southern beach of Ko Hi. Despite its remoteness, the beach contained an enormous amount of plastic waste that had accumulated there over the years. The team cleaned parts of the beach and brought everything possible to the base, where it is now sent to the recycling process.

UNEP’s Clean Seas Initiative and the Valiant Efforts of the Global Offshore Sailing Team

The United Nations Environment Programme’s (UNEP) Clean Seas Initiative is a vital global effort aimed at combating marine plastic pollution, a pressing environmental issue that threatens the health of our oceans and marine life. By rallying governments, businesses, and individuals to take decisive action, the Clean Seas Initiative is making significant strides towards achieving the Sustainable Development Goals (SDGs), particularly Goal 14: Life Below Water. A shining example of dedicated environmental stewardship is the Global Offshore Sailing Team (GOST), whose remarkable contributions have been recognized with the prestigious Bavarian States Medal.

Launched in 2017, UNEP’s Clean Seas Initiative has been instrumental in raising awareness and promoting effective solutions to tackle marine pollution. It engages stakeholders at various levels, encouraging them to adopt sustainable practices, reduce plastic production and consumption, and implement policies that protect the world’s oceans. As a result, the initiative has made considerable progress in fulfilling the targets set under SDG 14, which focuses on conserving and sustainably using marine resources.

The Global Offshore Sailing Team, a passionate group of sailors and environmentalists, has been a crucial ally in this fight against marine plastic pollution. Through their expeditions, GOST has taken the message of the Clean Seas Initiative to the most remote and inaccessible parts of the world’s oceans. Their dedication to raising awareness, conducting research, and collecting vital data on the impact of plastic pollution on marine ecosystems is unparalleled.

Throughout their journeys, GOST has engaged with local communities, schools, and institutions, empowering them with knowledge and resources to join the battle against marine pollution. They have also forged partnerships with various organizations, further amplifying the reach and impact of the Clean Seas Initiative.

In recognition of their unwavering commitment to environmental conservation, the Global Offshore Sailing Team was recently awarded the Bavarian States Medal. This prestigious honor reflects the immense value of GOST’s work in championing the goals of the UNEP’s Clean Seas Initiative and their broader contributions to the global sustainability agenda.

The achievements of the Clean Seas Initiative and the Global Offshore Sailing Team are a testament to the power of collective action in addressing the urgent issue of marine plastic pollution. Their inspiring efforts serve as a reminder that every individual, community, and organization has a role to play in safeguarding the health of our oceans and preserving them for future generations.