Original published in German in the Handelsblatt KI-Summit “KI-Business Guide”. Translation performed by DeepL.com

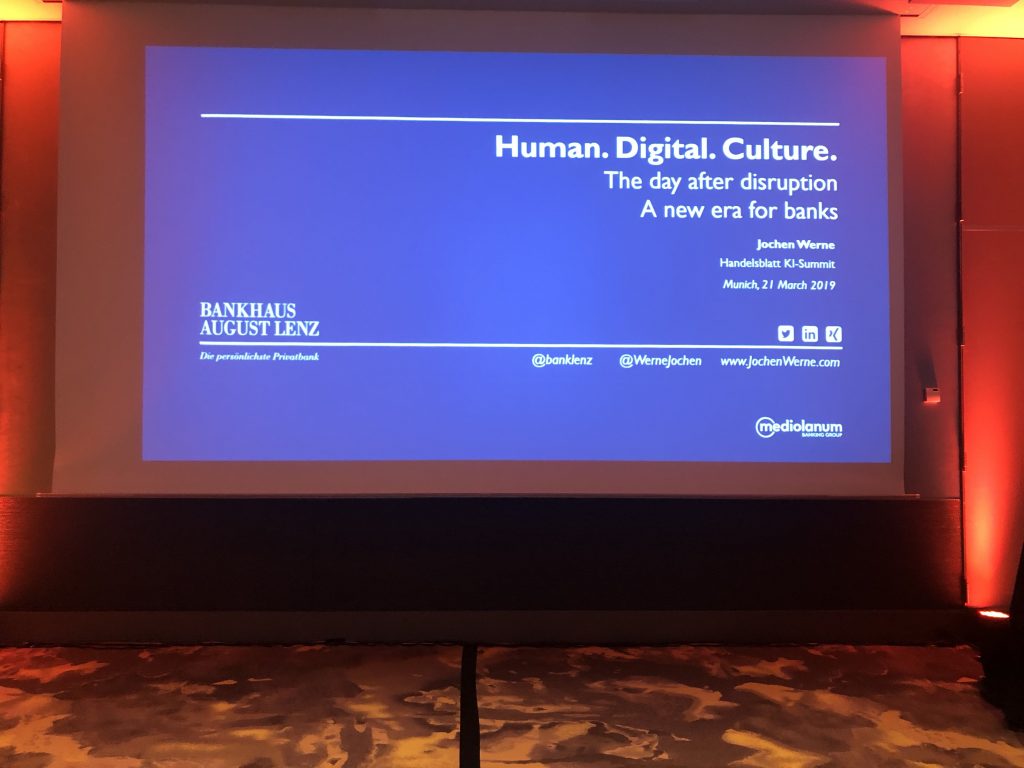

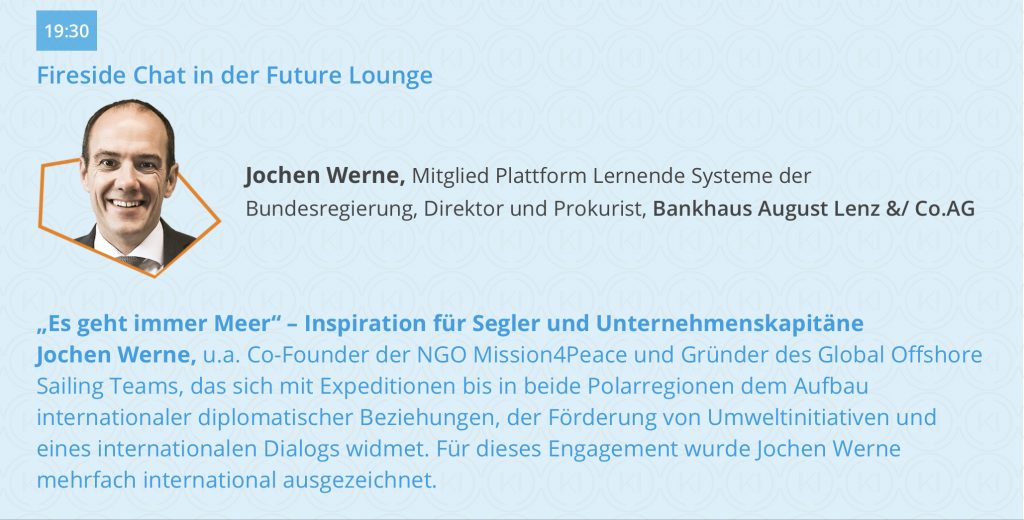

AI is making its way into every industry, but banks, insurance companies and FinTechs in particular are seeing a renaissance for their data-based business models in disruptive times. Jochen Werne, director and head of the innovation team at Munich-based private bank Bankhaus August Lenz, explains the role that the human factor will play in banking and consulting in the future.

Google, Apple, Facebook and Amazon (GAFA) have long seen artificial intelligence as the technology of the future. Banks and insurance companies also see the potential in machine and deep learning approaches to be a relevant player in the future in an increasingly technology-driven market environment. After “FinTech”, “Blockchain” and “Crypto-currencies”, “AI” is the new buzzword of the industry. From the AI-optimized chatbot to highly complex, self-learning, investment algorithms – the omnipresence of the term suggests that the integration of Artificial Intelligence into one’s own business model seems to be virtually necessary for survival. But is that really the case, where do we stand and which factors cannot be replaced by technology?

What becomes possible in times of exponential technologies is de facto nothing less than a revolution. The financial industry holds a vast amount of valuable and already processed data. Not only do they reflect our daily and extremely private life, from buying tickets for the subway via apps to the preference of our garments – but they reflect also the payment flows of entire companies and industries, and therefor our entire economy. Maturing AI systems not only make it easier to prepare and process this data, they also make it much cheaper, faster and more targeted. AI will not only enable banks to make their services more customer centric, it will also transform most areas of the financial industry – from asset management to business operations and money laundering prevention to marketing.

Data protection has top priority

Every major technological leap has historically been accompanied by a positive and an abusively usable development. TIME magazine recently published an article by Apple CEO Tim Cook entitled “It’s time for action on privacy. We all deserve control over our digital life”. Every electronic transaction generates customer-specific data. These structured data sets, which have been collected for many years, are now becoming the most valuable raw material. It’s important to create meaningful use-cases especially when it comes to the enrichment of existing structured data sets with external, possibly unstructured data. However, this is exactly where the risk lies. If sensitive data falls into the wrong hands and is deliberately misused, cyber attacks can cause considerable damage to individuals and groups. Trust is and remains therefore one of the most important assets of a credit institution or financial service provider. Consequently, the protection of customer data in a digital banking world has absolute priority today more than ever before. When using AI technology, it is therefore essential to use private and sensitive data in the interests of the customer. And this is where not only IT and cyber security departments of banks come into play, but also politics: their primary task must be to find meaningful solutions for handling the effects of the use of AI on society, the economy and thus on our lifes and the work of tomorrow. And this without endangering the competitiveness of our own country. The fact that this topic is taken seriously is evident not only in national initiatives such as the German Platform for Artificial Intelligence “Lernende Systeme”, but also, for example, in the European Artificial Intelligence shoulder-to-shoulder approach, which is being pushed forward at full speed by France and Germany.

The ideal model for private customer business: Connection of AI and human-based advise

In order to advance the acceptance of AI in the financial sector, it is important that existing digital tools are even better adapted to customer needs. The successful symbiosis between people and digital technology is indispensable. With the help of online financial forums, banking apps, vlogs and digital industry comparisons, private individuals can now achieve basically the same level of knowledge as financial professionals, but what is usually lacking is the successful filtering of the “information overload” and the consideration of the behavioral finance problem.

A realistic model for the successful transformation of the financial sector is therefore quite simple: streamline business models and processes, use data efficiently and always place the needs of customers at the centre of all activities. Taking advantage from technological progress always comes with successful deployment scenarios. Consequently, the technological revolution associated with the use of AI systems can only succeed if it is accepted by society – meaning, by us humans.