By Jochen Werne.

Duesseldorf, 5 November 2023

Introduction

From the eloquent words of Shakespeare in Henry V, where he once proclaimed, “all things are ready if our minds be so”^1 to the monumental shifts brought by Gutenberg’s printing press^2, history reminds us that change is both an inevitable and defining characteristic of human progress. As the world stands at the threshold of a new epoch marked by rapid technological shifts and pronounced geopolitical transformations, this profound sentiment compels us to reflect on the paramount importance of preparedness and perspective. The way societies respond to these shifts determines the direction of their trajectory. In our current age, Europe finds itself at the nexus of global transformations driven by technological advancements and geopolitical tectonics.

Technology: A Historical Reflection

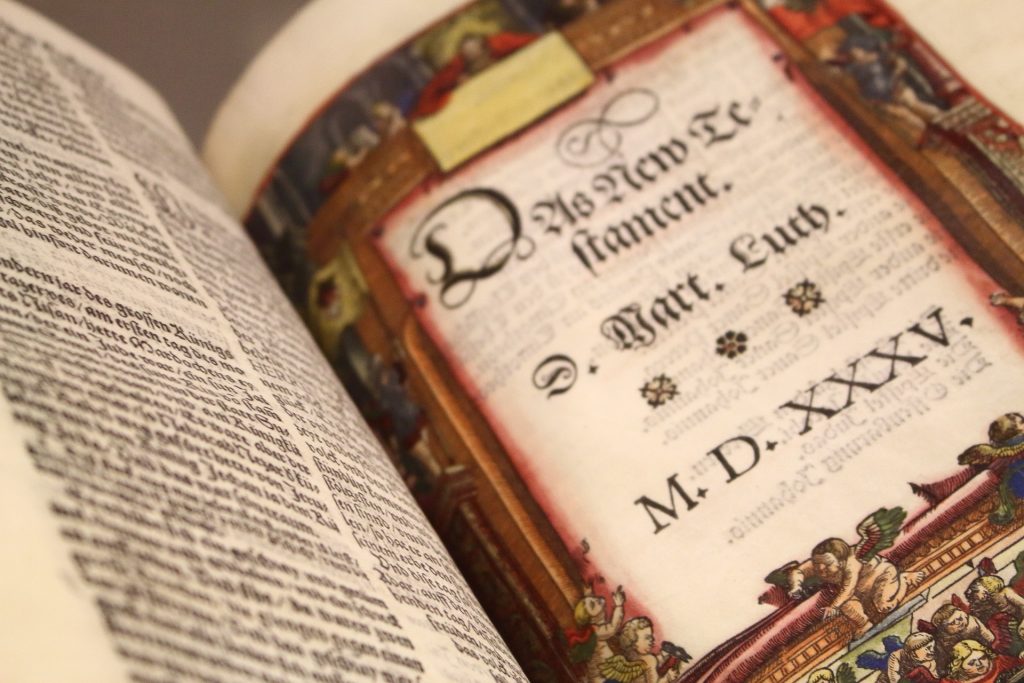

Peering through the lens of history, one quickly realizes that technology has been both a beacon of hope and an augury of upheaval. Take the 15th century’s monumental invention of the printing press as a case in point^2. This groundbreaking innovation democratized access to information and catalysed a substantial uptick in literacy rates across Europe. As Eisenstein posits, the “Printing Revolution” catalyzed an era where knowledge was no longer the privilege of the few but a right of the many^2. Yet, its reverberations were not confined to just reading and writing. The press became the vessel through which Martin Luther disseminated his Ninety-Five Theses, triggering a religious revolution that reshaped the European continent.

However, the journey wasn’t without turbulence. This democratization of knowledge played a pivotal role in challenging the established order, culminating in events like the Reformation, which MacCulloch describes as Europe’s great house divided^3.

Niall Ferguson, in “The Square and the Tower”, beautifully illustrates the timeless tension and interplay between networks and hierarchies^4. Historically, technologies like the printing press have emerged as disruptors, challenging established orders and reshaping hierarchies. The press, for instance, allowed for the free flow of ideas, becoming an early network that democratized information. Yet, not everything it propagated was for the betterment of society. The infamous “Malleus Maleficarum”, an ostensibly scholarly treatise, fueled the flames of the European witch hunts, leading to persecution, paranoia, and a dark chapter in history^5.

From Past to Present: The Tech Geopolitical Nexus

Fast forward to the present, and we witness a world where technology continues to shape geopolitical realities. Maddison’s macro-economic study reveals that the global center of economic gravity has been steadily shifting towards the East, particularly since the dawn of the 21st century^6. Nowhere is this shift more apparent than in the realm of technology.

The US-China tech rivalry, explored by Fuller, highlights the strategic challenges posed by China’s technological ascent^7.

The race for supremacy in AI, quantum computing, 5G, and biotechnologies marks the modern-day power play. But this isn’t merely about technological one-upmanship; it signifies a larger canvas of geopolitics, economics, and even societal values.

Many analysts are drawing parallels to the Cold War, coining the term “Tech Cold War” or “Cold War II”. Unlike the 20th-century version, primarily characterized by nuclear deterrence between the USSR and the US, this new Cold War positions the US and China in an intense rivalry for technological, economic, and military dominance. In the midst of this rivalry, both nations are hyper-aware of the stakes.

Navigating the Waters of New Geopolitical Paradigms

More than a century ago, the naval strategist Alfred Thayer Mahan, in his seminal work on sea power, postulated that maritime dominance was crucial to national greatness.

Today the Indo-Pacific has become the focal point of 21st-century geopolitics. Here, China’s assertive ‘Two Ocean Strategy’ is emblematic of its ambitions to exert influence both in the Pacific and the Indian Ocean. This expansive maritime vision is not just about sea lanes and trade; it’s a reflection of China’s aspirations to be a global power.

Simultaneously, the Taiwan question looms large in this maritime strategy. Its strategic location in the first island chain poses both an opportunity and a challenge for Beijing. Control over Taiwan would offer unencumbered access to the broader Pacific.

However, the rise of one power often brings countermeasures by others. The ‘AUKUS’ agreement between Australia, the United Kingdom, and the United States is a manifestation of this dynamic. While cloaked in the language of technological collaboration, especially in the realm of nuclear-powered submarines, the underlying intent of AUKUS is clear. It seeks to counterbalance China’s growing naval capabilities and assertiveness, particularly in the South China Sea.

Reflecting on Mahan’s sea power doctrine in this context provides a sobering perspective. Mahan believed that maritime dominance was the linchpin of global influence. Yet, he also understood the responsibilities and challenges that came with such power. In our contemporary setting, while nations pursue their maritime strategies, it is imperative they also embrace the principles of dialogue, cooperation, and conflict avoidance.

Taiwan epitomizes this interplay. As a beacon in semiconductor manufacturing, Taiwan’s geopolitical relevance can’t be overstated. Any instability could trigger economic consequences potentially dwarfing the aftermath of the Covid-19 pandemic^9.

Taiwan and Europe: Quietly Interwoven, Profoundly Connected.

In the intricate web of global technology supply chains, few names stand out as prominently as Taiwan Semiconductor Manufacturing Company (TSMC). Founded in 1987, TSMC has ascended the technological hierarchy to become the world’s leading semiconductor foundry, a testament to its unwavering commitment to innovation and excellence.

TSMC’s significance is multifaceted. For one, it’s the world’s largest dedicated independent semiconductor foundry^8. With clients ranging from major tech giants like Apple and Nvidia to burgeoning startups, TSMC’s production underpins a vast swathe of the digital products and solutions we rely on daily. However, TSMC’s role isn’t merely a commercial or technological one. It is geopolitical. With the escalating “Tech Cold War” between the U.S. and China, TSMC finds itself at an intriguing junction. The company’s strategic importance is underscored by global reliance on its cutting-edge chip manufacturing capabilities. This reliance has not only made TSMC a coveted partner but also a strategic asset in the larger scheme of global geopolitics. The U.S. push to ensure TSMC sets up manufacturing bases on its soil, and China’s keen interest in the semiconductor sector, highlights the foundry’s pivotal position.

Furthermore, TSMC embodies Taiwan’s broader significance in the tech world. As the geopolitical tussle intensifies, Taiwan – and by extension, TSMC – becomes a linchpin for global tech supply chains. A disturbance in TSMC’s operations, as speculated, could have cascading ramifications across industries, from consumer electronics to automotive and healthcare. Any significant disruption in this intricate supply chain would reverberate globally, with experts suggesting a potential 5% drop in global automotive production^9.

As chips become smaller, denser, and more powerful, the precision and capability of lithography machines must evolve in tandem.

Here’s where Europe and ASML, a Dutch gem, comes into play. The company is the sole producer of extreme ultraviolet (EUV) lithography machines^8, an advanced technology that allows for the creation of incredibly dense and efficient chips. With transistors now approaching atomic scales, EUV lithography is no less than a technological marvel, allowing chipmakers to etch circuits just a few nanometers wide.

However, the conversation around ASML isn’t merely about technological mastery. Given its unique position as the only producer of these EUV machines, ASML enjoys a quasi-monopolistic status in this niche yet profoundly impactful domain. In an era where technological supremacy is increasingly intertwined with geopolitical power, also ASML’s importance cannot be overstated. The machines they produce are not just expensive and sophisticated pieces of equipment; they are, in many ways, gatekeepers to the next generation of digital innovation.

Such a near-monopoly naturally draws attention. Nations and corporations are keenly aware of the strategic value inherent in controlling or accessing state-of-the-art chipmaking technology. With the ongoing technological cold war, where semiconductor supply chains have become part of the geopolitical chessboard, ASML finds itself in a spotlight it never sought but cannot avoid.

Europe’s Crucial Pivot

Europe’s position in this evolving tech landscape is unique. While traditionally viewing the Atlantic alliance as a cornerstone of its foreign policy, the rise of China necessitates a recalibrated approach^10. Europe’s interlinked trade with China, especially through critical chokepoints like the Malacca Strait, underscores the strategic dimension of this relationship^11.

In this whirlwind of technological and geopolitical flux, Europe is not an idle spectator. With a collective GDP nearing $22 trillion, it wields considerable influence. Europe’s role is multi-dimensional: an economic powerhouse, a voice of reason in tumultuous times, and often a mediator in global disputes.

The European Central Bank (ECB) embodies Europe’s proactive stance^12. Recognizing the flux, the ECB’s vision for 2023-2025 zeroes in on three pillars:

The ECB recognizes that the financial institutions it oversees must adapt to these transformative times. A crucial element of this adaptation is embracing digitalization, with a special emphasis on robust data-driven risk management.

- Strengthening Resilience: The intricate web of global economies translates to shared vulnerabilities. It’s imperative for Europe’s financial edifice to be robust, equipped to handle external shocks, and maintain systemic stability.

- Digitalisation & Institutional Strengthening: The burgeoning fintech sector necessitates a complete metamorphosis for legacy banks. This isn’t a mere cosmetic digital overhaul. Banks need to internalize and deploy intelligent digitalization. Central to this transformation is data analytics, supercharged by AI. Harnessing data, drawing meaningful insights, and predicting trends will determine who thrives in this new era.

- Climate Change Initiatives: Europe has consistently championed sustainability. The financial sector’s alignment with green, sustainable practices isn’t just altruistic; it’s also economic prudence, ensuring long-term viability and stability.

The above mentioned ECB focus is highlighted by Experian’s 2023 report on why AI-driven, regulatory-compliant analytics solutions are becoming imperative for European banks^13.

The AI Paradigm: Europe’s value-based Ethical Approach

Europe’s approach to AI regulation, championing the cause of ‘explainable AI’, shows its commitment to integrating technology with ethics. This dedication harks back to its legacy of literacy and the importance of accessibility, a theme explored by Graff^14. As Europe navigates the ‘Asian Century’^15, it does so with a clear vision: to leverage its historical experiences and chart a course that balances innovation with ethical considerations. The European AI Act encapsulates this approach. The Act’s core philosophy revolves around ensuring AI applications are safe and respect existing laws and values. This includes transparency obligations, strict criteria for ‘high risk’ AI applications, and a provision for setting up a European Artificial Intelligence Board.

One might wonder, why the emphasis on explainability? As AI systems permeate critical sectors, from healthcare to finance, their decisions can profoundly impact individuals. An ‘explainable AI’ ensures that these decisions are not just accurate but also comprehensible to the average person. This empowers individuals, fostering trust in AI systems.

The Act, however, isn’t just about explainability. It recognizes the diverse applications of AI and categorizes them based on risk. For ‘high-risk’ applications, stringent requirements, from transparency to accuracy and security, are mandated. This stratified approach ensures that while innovation isn’t stifled, critical areas receive the scrutiny they warrant.

Economic Powerhouses: A Comparative Analysis

Any discussion on global transformation would be incomplete without examining the economic engines driving these changes. China’s astounding growth, with a GDP of $17.7 trillion by 2022^16, and its decade-long average annual growth rate of 6.5%, contrasts with the US’s $25.3 trillion GDP and a more conservative 2.3% growth rate^17. The European Union, showcasing resilience and integration, clocks a collective GDP nearing $22 trillion^18, with trade figures underscoring its global economic clout^19.

Conclusion: Europe’s Way Forward

Our world is in a state of flux, reminiscent of those transformative moments in history. From the monumental shifts of the Printing Revolution^2 to the divisive yet transformative Reformation^3, Europe has witnessed and shaped global trajectories. As it stands at the crossroads of another transformation, it draws from its rich historical tapestry, aiming to strike a balance between embracing the future and preserving its core values.

The digital future beckons, but it’s not without its challenges. Whether it’s the complex web of tech geopolitics or the imperative of sustainable growth, Europe’s journey forward will need to be both adaptive and principled. At the heart of this journey lies the potent combination of data and ethics. And as Europe strides into the future, it carries with it a clear message: progress, when rooted in ethics and driven by knowledge, can usher in an era that’s not just technologically advanced but also just, balanced, and peaceful.

Footnotes:

^1 Shakespeare, William. “Henry V.” Act IV, Scene 3. ^2 Eisenstein, Elizabeth L. “The Printing Revolution in Early Modern Europe.” Cambridge University Press, 1983. ^3 MacCulloch, Diarmaid. “Reformation: Europe’s House Divided 1490-1700.” Penguin UK, 2004. ^4 Ferguson, Niall. “The Square and the Tower: Networks and Power, from the Freemasons to Facebook.” Penguin, 2018. ^5 Kramer, Heinrich and Sprenger, James. “Malleus Maleficarum.” Dover Publications, 1971. ^6 Maddison, Angus. “Contours of the World Economy 1-2030 AD: Essays in Macro-Economic History.” Oxford University Press, 2007. ^7 Fuller, Douglas B. “Cutting off our nose to spite our face: US policy toward Huawei and Taiwan in the shadow of the Chinese tech challenge.” International Security 45.3 (2021): 52-89. ^8 Chappell, Bill. “ASML: The Obscure Dutch Company That’s Enabling Big Advances In Tech.” NPR, 2019. ^9 “The Economic Impact of a Taiwan Crisis.” Nikkei Asia, 2023. ^10 Casarini, Nicola. “The Rise of China and the Future of the Atlantic Alliance.” Oxford University Press, 2020. ^11 Lanteigne, Marc. “China’s Maritime Security and the ‘Malacca Dilemma’.” Asian Security 4.2 (2008): 143-161. ^12 “European Central Bank Annual Report.” 2023. ^13 Experian PLC. “Annual Report and Financial Statements.” 2023. ^14 Graff, Harvey J. “The Legacies of Literacy: Continuities and Contradictions in Western Culture and Society.” Indiana University Press, 1987. ^15 Khanna, Parag. “The Future is Asian: Commerce, Conflict, and Culture in the 21st Century.” Simon and Schuster, 2019. ^16 “World Bank Data: China.” 2022. ^17 “World Bank Data: United States.” 2022. ^18 “World Bank Data: European Union.” 2022. ^19 “European Commission Trade Statistics.” 2022.

About the author

Jochen Werne is CEO of Experian DACH. Large-scale global data powerhouses like Experian with it’s more than 20.000 data and analytics experts and a market cap of nearly €30bn have a pivotal role to play in this evolving narrative. As a global vanguard in data analytics, Experian is uniquely poised to offer financial institutions the insights and tools essential for navigating the multifaceted challenges of our times. In a world inundated with data, discerning patterns, understanding trends, and anticipating potential pitfalls will be the linchpin of success.